Terminating Health Benefits for Employees on Disability Leave

By Brian Gilmore | Published December 15, 2018

Question: When does an employee on disability leave lose active health plan coverage and become eligible for COBRA?

Compliance Team Response:

Active Health Benefits Continue: FMLA/CFRA/PDL Period (or Other State Protected Leave Law)

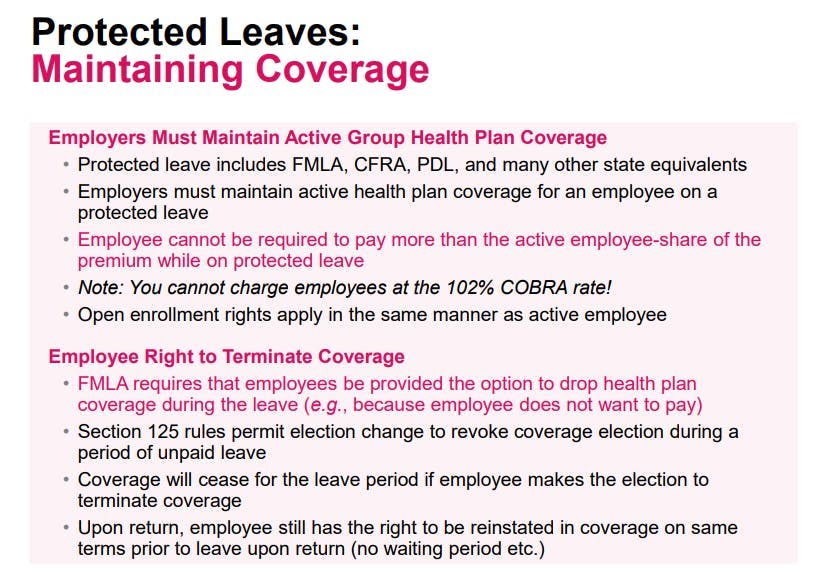

Employees who are disabled may have job protected rights under FMLA/CFRA for up to 12 weeks. Pregnancy disabilities also include a period of protected PDL leave, which extends the protected leave period. During the protected leave period, the employee will remain on active coverage (unless the employee elects otherwise) and pay the standard active employee-share of the premium.

We have a full summary of protected leave rights here: Newfront Leave Chart (Federal/CA/SF)

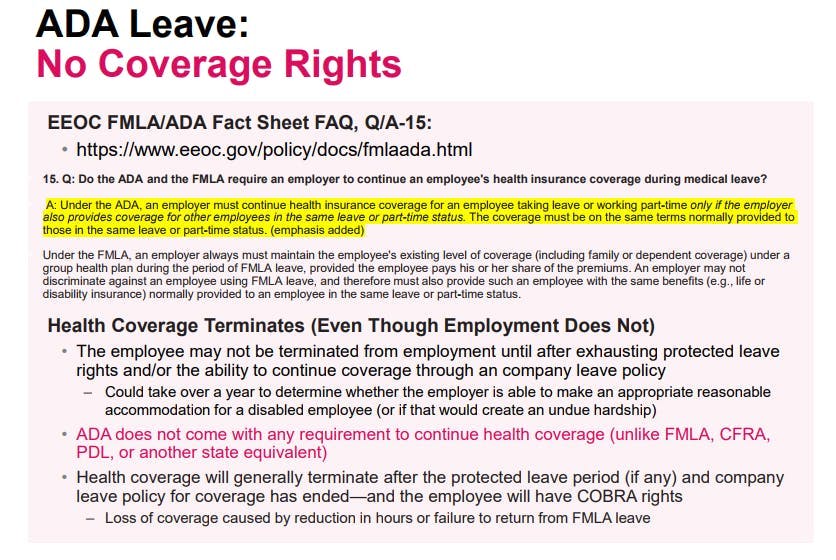

Active Health Benefits Generally Do Not Continue: ADA Assessment Period/Workers Compensation Period

After any FMLA/CFRA/PDL protected leave period, employers will generally keep disabled employees listed as an employee for a significant period. This means that although the employee is not working, the employee has not been terminated.

Employers do not terminate disabled employees in this post-protected leave period because it can take a long time (in some cases, more than a year) for employers to assess whether they can make a reasonable accommodation under the ADA for an employee out on disability, or if that would impose an undue hardship on the employer’s business operations.

The employee is not actively working during that ADA assessment period, and therefore the employee would not be entitled to continue active health benefits (after any FMLA/CFRA/PDL period). This is true regardless of whether the employee is receiving workers compensation benefits.

(Note that the eligibility determination during the ADA assessment period can be more complex if the employer is utilizing the ACA look-back measurement method to determine full-time status and eligibility for the health plan. See our prior FAST on the ACA look-back measurement method.

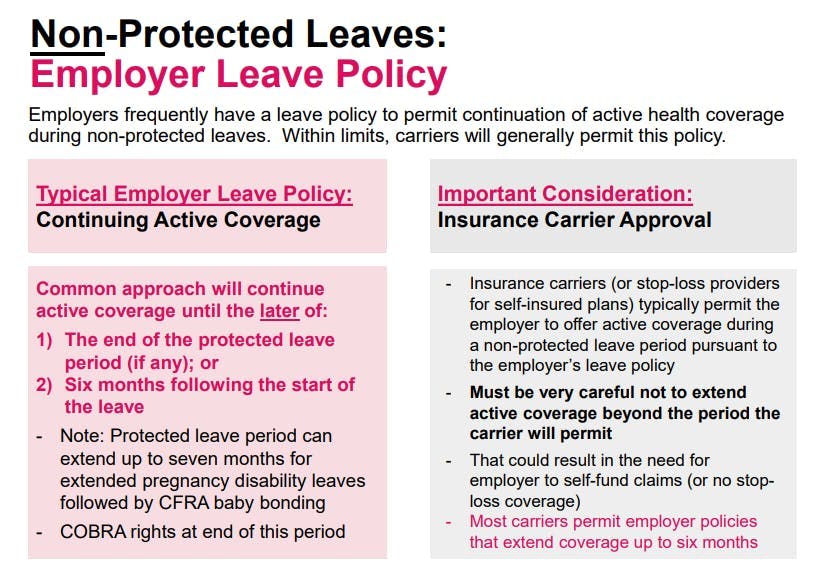

Exception: Employer Leave Policy Extension of Active Health Coverage

The exception to the general rule above would be if the employer has a company LOA policy that states otherwise. For example, some employers continue active coverage for employees on a leave of absence after the protected leave period (or where no protected leave was available at the outset) pursuant to their internal leave policies. The insurance carrier (or stop-loss provider if self-insured) will often permit these extensions for a period of up to six months from the outset of the leave.

Those company LOA policies (if any) would also need to extend in the same manner to employees during this ADA assessment period.

To summarize:

An employee’s disability or entitlement to workers compensation benefits is not protected leave, other than the period (if any) protected by FMLA/CFRA/PDL (or another state equivalent). There is no requirement to continue active coverage once the protected leave period (if any) is exhausted.

After the protected leave period (if any), the company may not be able to terminate the employee from employment for an extended period because of ADA protections.

The ADA assessment period does not come with any requirement to continue health coverage (unlike FMLA, CFRA, PDL, or another state equivalent).

Therefore, once the FMLA or CFRA/PDL (or other state equivalent) leave has ended, the company will generally terminate the employee’s active health coverage and offer COBRA. The COBRA qualifying event will be loss of coverage based either on a reduction in hours or failure to return from FMLA leave–both of which are COBRA qualifying events.

The exception to this general practice would be if the employer has a more generous leave policy to continue coverage beyond the required protected leave timeframe (generally with an outer limit not to exceed six months, as determined by the insurance carrier or stop-loss provider).

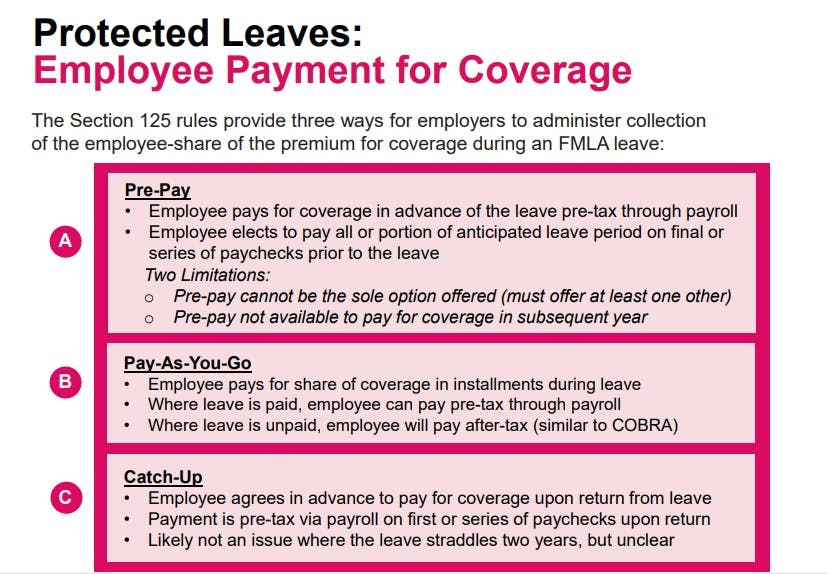

If the employer continues coverage pursuant to a company leave policy, the premium payment would be handled through the standard pre-pay, pay-as-you-go, or catch-up payment options outlined below.

Regulations

EEOC FMLA/ADA Fact Sheet FAQ, Q/A-15:

http://www.eeoc.gov/policy/docs/fmlaada.html

1) Q: Do the ADA and the FMLA require an employer to continue an employee’s health insurance coverage during medical leave?

A: Under the ADA, an employer must continue health insurance coverage for an employee taking leave or working part- time only if the employer also provides coverage for other employees in the same leave or part-time status. The coverage must be on the same terms normally provided to those in the same leave or part-time status.

Under the FMLA, an employer always must maintain the employee’s existing level of coverage (including family or dependent coverage) under a group health plan during the period of FMLA leave, provided the employee pays his or her share of the premiums. An employer may not discriminate against an employee using FMLA leave, and therefore must also provide such an employee with the same benefits (e.g., life or disability insurance) normally provided to an employee in the same leave or part-time status.32

Treas. Reg. §54.4980B-4, Q/A-1(b)(5):

Q-1. What is a qualifying event?

A-1.

…

(b) An event satisfies this paragraph (b) if the event is any of the following—

(1) The death of a covered employee;

(2) The termination (other than by reason of the employee’s gross misconduct), or reduction of hours, of a covered employee’s employment;

(3) The divorce or legal separation of a covered employee from the employee’s spouse;

(4) A covered employee’s becoming entitled to Medicare benefits under Title XVIII of the Social Security Act (42 U.S.C. 1395-1395ggg);

(5) A dependent child’s ceasing to be a dependent child of a covered employee under the generally applicable requirements of the plan; or

(6) A proceeding in bankruptcy under Title 11 of the United States Code with respect to an employer from whose employment a covered employee retired at any time

Treas. Reg. §54.4980B-10, Q/A-1(a):

Q-1. In what circumstances does a qualifying event occur if an employee does not return from leave taken under FMLA?

A-1. (a) The taking of leave under FMLA does not constitute a qualifying event. A qualifying event under Q&A-1 of §54.4980B-4 occurs, however, if—

(1) An employee (or the spouse or a dependent child of the employee) is covered on the day before the first day of FMLA leave (or becomes covered during the FMLA leave) under a group health plan of the employee’s employer;

(2) The employee does not return to employment with the employer at the end of the FMLA leave; and

(3) The employee (or the spouse or a dependent child of the employee) would, in the absence of COBRA continuation coverage, lose coverage under the group health plan before the end of the maximum coverage period.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn