Registered Domestic Partners and Company-Defined Domestic Partners

By Brian Gilmore | Published February 28, 2020

**Question: **What are the differences between a Registered Domestic Partner and a company-defined domestic partner for health plan purposes?

**_Short Answer: _ **Employers with a fully insured plan in California must offer coverage to Registered Domestic Partners on the same terms as spouses, but many employers choose to also offer coverage more broadly to company-defined domestic partners.

California Registered Domestic Partners: General Rule

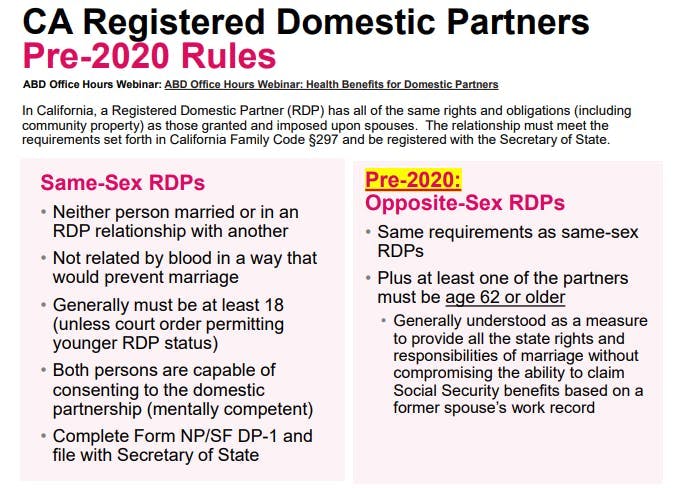

In California, a Registered Domestic Partner (RDP) has all of the same rights and obligations (including community property) as those granted and imposed upon spouses. RDPs must meet the requirements set forth in California Family Code §297 and be registered with the Secretary of State.

California Registered Domestic Partners: Pre-2020 Requirements

Prior to 2020, there were different RDP requirements for opposite-sex partners. The rules previously provided that an opposite-sex couple could enter into a RDP relationship only if at least one of the partners was age 62 or older.

This rule was generally understood as a measure to provide all of the state rights and responsibilities of marriage without compromising the RDP’s ability to claim Social Security benefits based on a former spouse’s work record. Prior to the _Windsor _and Obergefell U.S. Supreme Court decisions, in 2013 and 2015 respectively, it made sense to extend RDP rights more broadly to same-sex couples who generally could not enter into marriage.

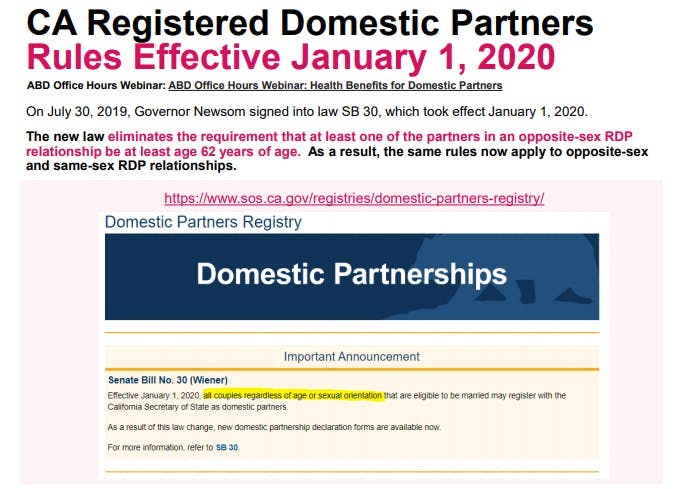

California Registered Domestic Partners: New Rules Effective 1/1/20 (Eliminating Age 62 Requirement)

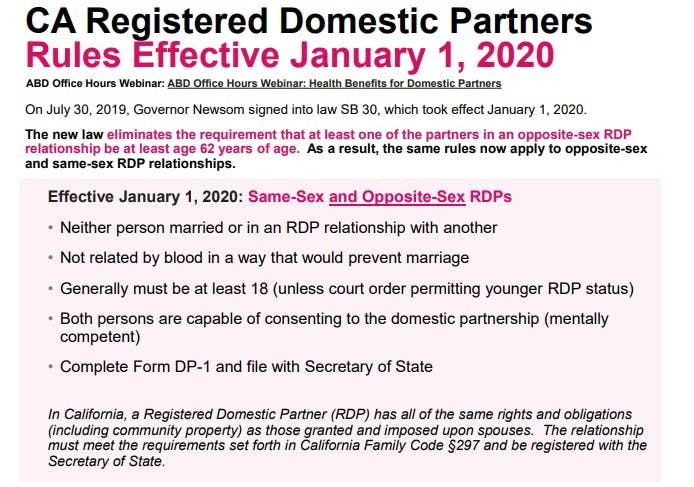

On July 30, 2019, Governor Newsom signed into law SB 30, which took effect January 1, 2020. The new law eliminates the requirement that one of the partners in an opposite-sex RDP relationship be at least 62 years of age. As a result, the same rules now apply to opposite-sex and same-sex RDP relationships.

As of January 1, 2020, the California RDP requirements for same-sex and opposite-sex couples are:

Neither person is currently married on in a RDP relationship with another;

The persons are not related by blood in a way that would prevent marriage;

Both persons must be at least 18 years old (absent a court order permitting younger RDP status);

Both persons are capable of consenting to the domestic partnership (mentally competent); and

They must complete Form DP-1 and file it with the California Secretary of State.

California Registered Domestic Partners: Insurance Mandate for Equal Coverage

California requires insurance carriers to provide coverage for RDPs on the same basis as spouses. This means that for any fully insured health plan option sitused in California, RDPs must have access to the same benefits offered to spouses.

This requirement does not apply to self-insured plans (including level-funded plans) because ERISA preempts state insurance laws for self-insured plans. For full details, see our previous post: ERISA Preemption of State Insurance Mandates.

California Registered Domestic Partners: Insurance Mandate for Equal Verification

California requires that RDPs be treated in the same manner as spouses with respect to verification of relationship status. This means that for any fully insured health plan sitused in California, employers cannot request that employees provide a copy of the Declaration of Domestic Partnership form filed with the Secretary of State to verify RDP status unless the employer also requests that employees provide a marriage certificate to verify marriage status.

Furthermore, in no case could the employer ever require that an employee in a RDP relationship provide more than the Declaration of Domestic Partnership as a condition of eligibility. For example, the employer could not require that a RDP complete the same affidavit commonly required for employees to establish domestic partner eligibility for a company defined domestic partner (non-RDP).

Note: These equal verification rules do not apply to company-defined (non-RDP) domestic partner eligibility. Employers commonly require employees to complete a domestic partnership affidavit to establish eligibility of a company-defined domestic partner regardless of whether they request verification of a marriage or RDP relationship.

California Registered Domestic Partners: State Income Tax Advantage

Employees who enroll a RDP on the health plan are treated in the same manner as a spouse enrollment for California state income tax purposes. This means that the employee is not subject to California state imputed income for a RDP’s health plan coverage.

Federal tax law does not recognize RDPs in the same manner as a spouse. Accordingly, federal imputed income will still apply for a RDP’s health coverage—unless the RDP is a tax dependent under Internal Revenue Code §152 (as modified by §105(b)).

For full details, see our previous post: Tax Consequences of Domestic Partner Health Coverage.

California Registered Domestic Partners: Other States

California recognizes registered domestic partnerships or civil unions entered into in another state in the same manner as a RDP relationship entered into in California. The registered domestic partnership or civil union entered into in another state must be “substantially equivalent” to a RDP relationship entered into in California.

A handful of other states still permit registered domestic partnerships or civil unions. The National Conference of State Legislatures (NCSL) maintains a useful database of these states: https://www.ncsl.org/research/human-services/civil-unions-and-domestic-partnership-statutes.aspx

Company-Defined Domestic Partners: Employer Discretion

Many employers prefer to offer domestic partner health plan coverage more broadly than what is required for RDPs. RDP status is the functional equivalent of marriage in California (including community property), and many employees do not want to enter into a serious, state-recognized relationship with significant rights and obligations to enroll their “domestic partner.”

As a recruiting and retention matter, it can be difficult to limit domestic partner eligibility exclusively to RDPs because many employees expect the ability to enroll an individual based on a relationship that meets a lower standard than the formal RDP status.

Company-Defined Domestic Partners: Domestic Partner Policy

Employers that choose to offer domestic partner coverage more broadly can develop their own domestic partner policy that permits employees to enroll their domestic partner simply by meeting the company’s definition of a domestic partner. These domestic partners are typically referred to as company-defined domestic partners or non-RDPs.

The insurance carrier (or stop-loss provider for self-insured plans) will almost always defer entirely to the company’s definition of a domestic partnership. Note, however, that some carriers require employers to declare in the application or renewal that they are offering coverage more broadly than the RDP requirements.

Company-Defined Domestic Partners: Verification

Although some employers choose not to require any form of verification, most employers require employees to complete an affidavit whereby employees attest to their relationship meeting the company-defined domestic partner status in order to enroll the domestic partner in the health plan.

This approach generally serves two primary purposes: 1) ensuring that employees are aware of the company’s domestic partner definition, and 2) preventing potential fraudulent enrollment to some degree.

Note: The equal verification rules for RDP relationships do not apply to company-defined (non-RDP) domestic partner eligibility. Employers commonly require employees to complete a domestic partnership affidavit to establish eligibility of a company-defined domestic partner regardless of whether they request verification of a marriage or RDP relationship.

Company-Defined Domestic Partners: Common Requirements

Company-defined domestic partner policies typically require all or some of the following elements to establish an eligible domestic partner:

Ongoing and committed relationship

Relationship has existed for a set period

Both individuals are at least 18 years old and competent to contract

Neither individual is currently married or in a RDP relationship with another

Intent to remain in the relationship indefinitely

Not related by blood in a way that would prevent marriage/RDP relationship

Share the same residence for a set period

Jointly responsible for each other’s financial obligations

Are not in the relationship solely for the purpose of health plan eligibility

Company-Defined Domestic Partners: Taxation

Federal and state imputed income will apply to an employee covering a company-defined domestic partner—unless the domestic partner is a tax dependent under Internal Revenue Code §152 (as modified by §105(b)).

For full details, see our previous post: Tax Consequences of Domestic Partner Health Coverage.

Same-Sex Spouses: Recognized Nationwide with Equal Treatment for All Purposes

Same-sex marriage is recognized throughout the entire United States. This has been the case since the U.S. Supreme Court’s 2015 decision in Obergefell.

This means that in all states same-sex spouses are treated identically for all tax and coverage purposes as opposite-sex spouses.

More Details on Domestic Partner Health Plan Issues

Regulations

California Family Code §297:

(a) Domestic partners are two adults who have chosen to share one another’s lives in an intimate and committed relationship of mutual caring.

(b) A domestic partnership shall be established in California when both persons file a Declaration of Domestic Partnership with the Secretary of State pursuant to this division, and, at the time of filing, all of the following requirements are met:

(1) Neither person is married to someone else or is a member of another domestic partnership with someone else that has not been terminated, dissolved, or adjudged a nullity.

(2) The two persons are not related by blood in a way that would prevent them from being married to each other in this state.

(3) Both persons are at least 18 years of age, except as provided in Section 297.1.

(4) Both persons are capable of consenting to the domestic partnership.

California Family Code §297.5(a):

(a) Registered domestic partners shall have the same rights, protections, and benefits, and shall be subject to the same responsibilities, obligations, and duties under law, whether they derive from statutes, administrative regulations, court rules, government policies, common law, or any other provisions or sources of law, as are granted to and imposed upon spouses.

California Family Code §299.2:

A legal union of two persons, other than a marriage, that was validly formed in another jurisdiction, and that is substantially equivalent to a domestic partnership as defined in this part, shall be recognized as a valid domestic partnership in this state regardless of whether it bears the name domestic partnership.

California Insurance Code §10121.7:

(a) A policy of group health insurance that provides hospital, medical, or surgical expense benefits shall provide equal coverage to employers or guaranteed associations, as defined in Section 10700, for the registered domestic partner of an employee, insured, or policyholder to the same extent, and subject to the same terms and conditions, as provided to a spouse of the employee, insured, or policyholder, and shall inform employers and guaranteed associations of this coverage. A policy shall not offer or provide coverage for a registered domestic partner that is not equal to the coverage provided to the spouse of an employee, insured, or policyholder, and shall not discriminate in coverage between spouses or domestic partners of a different sex and spouses or domestic partners of the same sex. The prohibitions and requirements imposed by this section are in addition to any other prohibitions and requirements imposed by law.

(b) If an employer or guaranteed association has purchased coverage for spouses and registered domestic partners pursuant to subdivision (a), a health insurer that provides hospital, medical, or surgical expense benefits for employees, insureds, or policyholders and their spouses shall enroll, upon application by the employer or group administrator, a registered domestic partner of the employee, insured, or policyholder in accordance with the terms and conditions of the group contract that apply generally to all spouses under the policy, including coordination of benefits.

(c) For purposes of this section, the term “domestic partner” shall have the same meaning as that term is used in Section 297 of the Family Code.

(d)

(1) A policy of group health insurance may require that the employee, insured, or policyholder verify the status of the domestic partnership by providing to the insurer a copy of a valid Declaration of Domestic Partnership filed with the Secretary of State pursuant to Section 298 of the Family Code or an equivalent document issued by a local agency of this state, another state, or a local agency of another state under which the partnership was created. The policy may also require that the employee, insured, or policyholder notify the insurer upon the termination of the domestic partnership.

(2) Notwithstanding paragraph (1), a policy may require the information described in that paragraph only if it also requests from the employee, insured, or policyholder whose spouse is provided coverage, verification of marital status and notification of dissolution of the marriage.

California Health & Safety Code §1374.58:

(a) A group health care service plan that provides hospital, medical, or surgical expense benefits shall provide equal coverage to employers or guaranteed associations, as defined in Section 1357, for the registered domestic partner of an employee or subscriber to the same extent, and subject to the same terms and conditions, as provided to a spouse of the employee or subscriber, and shall inform employers and guaranteed associations of this coverage. A plan shall not offer or provide coverage for a registered domestic partner that is not equal to the coverage provided to the spouse of an employee or subscriber, and shall not discriminate in coverage between spouses or domestic partners of a different sex and spouses or domestic partners of the same sex. The prohibitions and requirements imposed by this section are in addition to any other prohibitions and requirements imposed by law.

(b) If an employer or guaranteed association has purchased coverage for spouses and registered domestic partners pursuant to subdivision (a), a health care service plan that provides hospital, medical, or surgical expense benefits for employees or subscribers and their spouses shall enroll, upon application by the employer or group administrator, a registered domestic partner of an employee or subscriber in accordance with the terms and conditions of the group contract that apply generally to all spouses under the plan, including coordination of benefits.

(c) For purposes of this section, the term “domestic partner” shall have the same meaning as that term is used in Section 297 of the Family Code.

(d)

(1) A health care service plan may require that the employee or subscriber verify the status of the domestic partnership by providing to the plan a copy of a valid Declaration of Domestic Partnership filed with the Secretary of State pursuant to Section 298 of the Family Code or an equivalent document issued by a local agency of this state, another state, or a local agency of another state under which the partnership was created. The plan may also require that the employee or subscriber notify the plan upon the termination of the domestic partnership.

(2) Notwithstanding paragraph (1), a health care service plan may require the information described in that paragraph only if it also requests from the employee or subscriber whose spouse is provided coverage, verification of marital status and notification of dissolution of the marriage.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn