HSA Form W-2 Reporting

By Brian Gilmore | Published April 24, 2020

Question: What are the employer Form W-2 reporting requirements with respect to HSA contributions?

Short Answer: Both the employer and pre-tax employee HSA contributions made through payroll are reported on the Form W-2 in Box 12 with Code W.

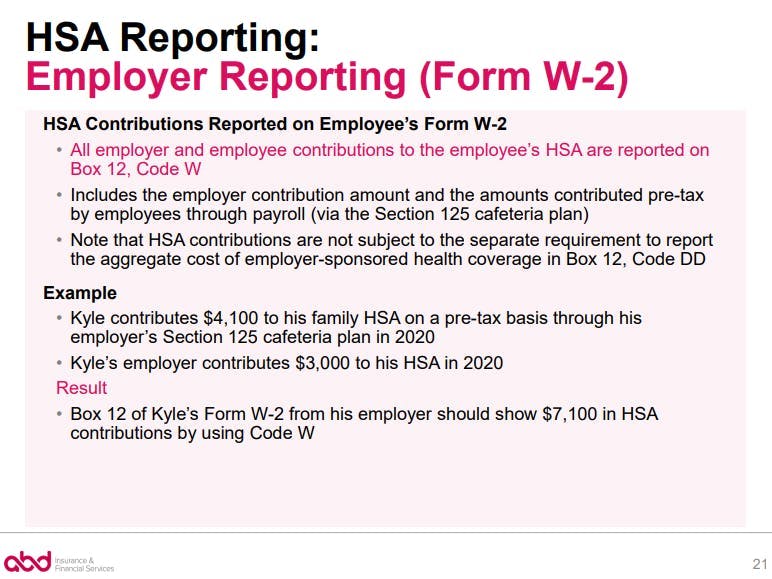

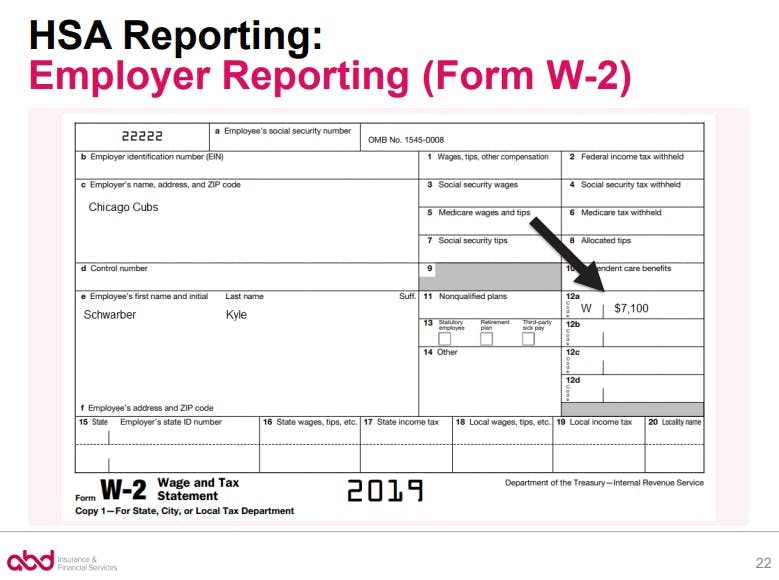

HSA Contributions Reported in Box 12, Code W

Employers must report all employer and employee HSA contributions made through payroll as a single aggregated amount on the employee’s Form W-2 in Box 12 using code W.

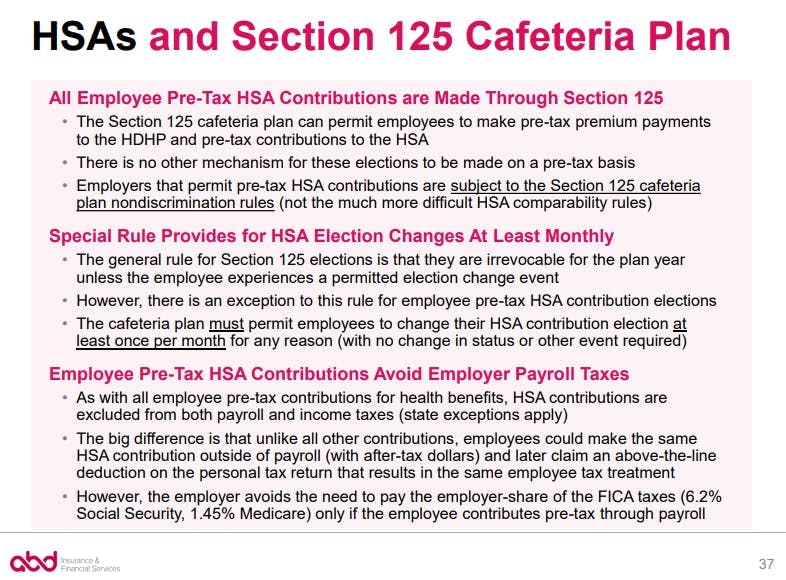

This reporting includes the employer contribution amount and the amounts contributed by employees pre-tax through payroll (via the Section 125 cafeteria plan).

Example:

Kyle is HSA-eligible with family HDHP coverage for all of 2020.

Kyle’s employer contributes $3,000 to his HSA in 2020.

Kyle contributes $4,100 to his HSA on a pre-tax basis through his employer’s Section 125 cafeteria plan in 2020.

Result:

The employer must report both the employer and employee HSA contributions as a single aggregated amount in Box 12 using Code W.

Box 12 of Kyle’s 2020 Form W-2 will show $7,100 in combined employer/employee HSA contributions with Code W.

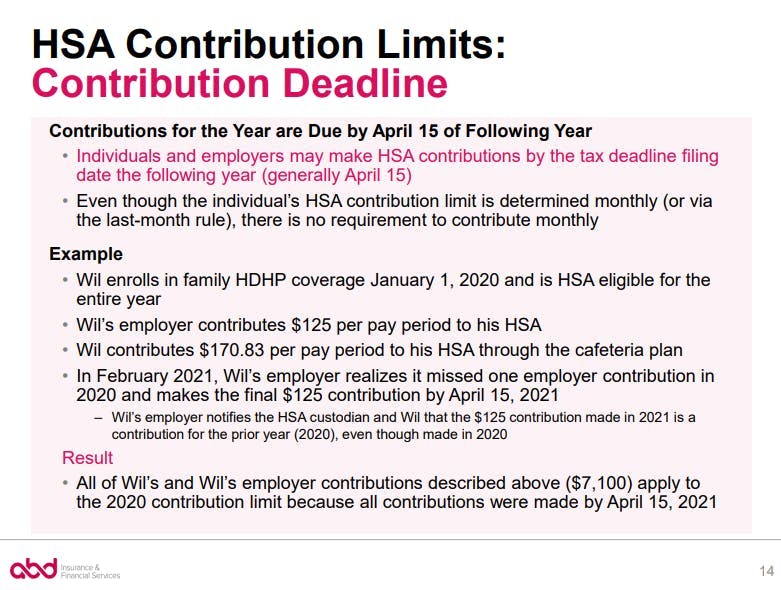

Employer Prior-Year HSA Contributions by Tax Filing Deadline Do Not Require Corrected Form W-2c

Employers or employees may discover a prior-year HSA contribution error when preparing or receiving the Form W-2. The most common of these errors is where the employer mistakenly missed one or more of the employer HSA contributions in the prior year because of a payroll error.

The good news is that this is an easily correctible mistake. The HSA rules provide that employers can make a prior-year missed HSA contribution by the tax filing deadline (generally April 15) by notifying both the employee and the HSA bank that the contribution is to be allocated to the prior year.

Furthermore, this HSA contribution correction does not require the employer to provide a corrected Form W-2c. IRS guidance confirms that employers simply report the prior-year HSA contribution on the current-year Form W-2 (issued the following January) even though this may result in the Box 12, Code W reporting showing an amount larger than the annual statutory HSA contribution limit. The employee will subtract the prior-year HSA contributions on the current-year individual tax return (generally filed by April 15 of the following year) when preparing the IRS Form 8889 to reflect that the contributions allocated to the current year remained within the statutory limit.

Example:

Kyle’s employer should have contributed $3,000 to his HSA in 2020.

However, Kyle discovers upon receipt of his 2020 Form W-2 that his employer contributed only $2,875 because it missed one payroll contribution.

Result:

The employer should correct the mistake by making the missed 2020 employer HSA contribution no later than April 15, 2021.

The employer must notify both Kyle and the HSA bank that the $125 deposit made in 2021 is to be allocated to 2020’s contribution limit.

The employer does not prepare a corrected 2020 Form W-2c to address the error.

Instead, the employer reports the 2020 contribution made in 2021 on Kyle’s 2021 Form W-2 provided in January 2022 (aggregated as one amount with the 2021 employer and employee HSA contributions, if any, in Box 12 using Code W).

Kyle will prepare his 2021 Form 8889 (in early 2022) to reflect that the $125 2020 HSA employer contribution made in 2021 was allocated to the 2020 contribution limit.

Potential Penalties

The primary potential penalty for failure to report HSA contributions in Box 12 using Code W are the standard Form W-2 penalties for incorrectly reporting income.

Those Form W-2 penalties are generally as follows:

$50 per Form W-2 if corrected within 30 days of the 1/31 due date ($556,500 annual maximum, reduced to $194,500 for small business)

$110 per Form W-2 if corrected after 30 days, but no later than August 1 ($1,669,500 annual maximum, reduced to $556,500 for small business)

$270 per Form W-2 if corrected after August 1 or not corrected ($3,339,000 annual maximum, reduced to $1,113,000 for small business)

$550+ per form W-2 if due to intentional disregard of the Form W-2 requirements (no annual maximum)

Note that these penalties apply once for the incorrect filing with the IRS, and once for the incorrect furnishing to employees. So they are generally doubled in practice. Corrections are generally reported via IRS Form W-2c.

Reminder: HSA Contributions are Not Included in the Form W-2 Cost of Coverage Reporting (Box 12, Code DD)

Employers that filed 250 or more Forms W-2 in the preceding calendar year are subject to a separate cost of coverage reporting added by the ACA. This reporting is addressed Box 12 using Code DD. This separate cost of coverage reporting on the Form W-2 does not include HSA contributions.

For full details, see our prior post: ACA Form W-2 Cost of Coverage Reporting.

For more information on everything HSA, see our Newfront 2020 Go All the Way With HSA Guide.

Regulations

IRS Form W-2 Instructions:

https://www.irs.gov/pub/irs-pdf/fw2.pdf

W— Employer contributions (including amounts the employee elected to contribute using a section 125 (cafeteria) plan) to your health savings account. Report on Form 8889, Health Savings Accounts (HSAs).

IRS Notice 2008-59, Q/A-21:

https://www.irs.gov/irb/2008-29_IRB#NOT-2008-59

Q-21. May employer contributions to employees’ HSAs made between January 1 and the date for filing the employee’s return, without extensions, be allocated to the prior year?

A-21. Yes. For employer contributions (including salary reduction contributions) made between January 1 and the date for filing the employees’ federal income tax return without extension, the employer must notify the HSA trustee or custodian if the contributions relate to the prior year. The employer must also inform the employee of the designation. However, the contributions designated as made for the prior year are still reported in box 12 with code W on the employees’ Form W-2 for the year in which the contributions are actually made.

Example. In January 2009, Employer K contributes $500 to each employee’s HSA and notifies the HSA trustee (and provides a statement to the employees) that the contributions are for 2008. Subsequently, in 2009, Employer K contributes $250 to each employee’s HSA on March 31, June 30, September 30 and December 31. For each employee whose HSA received these contributions, Employer K reports a total contribution of $1,500 in box 12 with code W on the Form W-2 for 2009.

In completing the Form 8889 for 2008, to compute Employer K’s contributions, the employees add the $500 to any employer contributions reported in box 12, code W on the 2008 Form W-2. In completing the Form 8889 for 2009, the employees subtract the $500 from the box 12 code W amount on the 2009 Form W-2 and add to the remaining $1,000 any contributions for 2009 made by Employer K between January 1, 2009 and his or her filing date without extensions. See Instructions to Form 8889.

IRS Form 8889 Instructions:

https://www.irs.gov/pub/irs-pdf/i8889.pdf

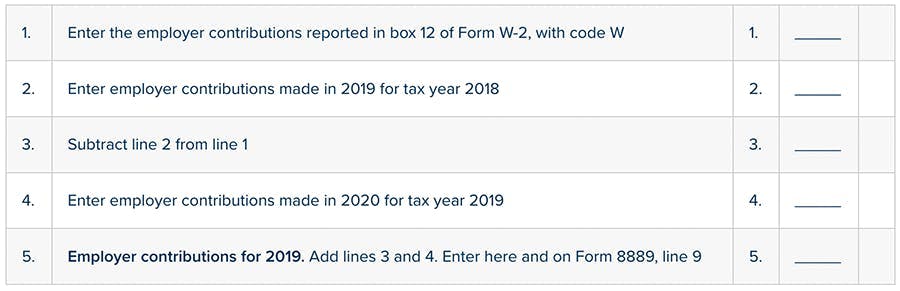

Employer Contributions

Employer contributions (including contributions through a cafeteria plan) include any amount an employer contributes to any HSA for you for 2019. These contributions should be shown in box 12 of Form W-2 with code W. If either of the following apply, complete the Employer Contribution Worksheet.

Employer contributions for 2018 are included in the amount reported in box 12 of Form W-2 with code W.

Employer contributions for 2019 are made in 2020.

If your employer made excess contributions, you may have to report the excess as income. See Excess Employer Contributions, later.

Employer Contribution Worksheet

IRS Forms W-2 and W-3 Instructions

https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

Failure to file correct information returns by the due date.

If you fail to file a correct Form W-2 by the due date and cannot show reasonable cause, you may be subject to a penalty as provided under section 6721. The penalty applies if you:

Fail to file timely,

Fail to include all information required to be shown on Form W-2,

Include incorrect information on Form W-2,

File on paper forms when you are required to e-file,

Report an incorrect TIN,

Fail to report a TIN, or

Fail to file paper Forms W-2 that are machine readable.

The amount of the penalty is based on when you file the correct Form W-2. Penalties are indexed for inflation. The penalty amounts shown below apply for filings due after December 31, 2019. The penalty is:

$350 per Form W-2 if you correctly file within 30 days of the due date; the maximum penalty is $556,500 per year ($194,500 for small businesses, defined in Small businesses).

$110 per Form W-2 if you correctly file more than 30 days after the due date but by August 1; the maximum penalty is $1,669,500 per year ($556,500 for small businesses).

70 per Form W-2 if you file after August 1, do not file corrections, or do not file required Forms W-2; the maximum penalty is $3,339,000 per year ($1,113,000 for small businesses).

If you do not file corrections and you do not meet any of the exceptions to the penalty, the penalty is $270 per information return. The maximum penalty is $3,339,000 per year ($3,113,000 for small businesses).

…

Intentional disregard of filing requirements.

If any failure to timely file a correct Form W-2 is due to intentional disregard of the filing or correct information requirements, the penalty is at least $550 per Form W-2 with no maximum penalty.

Failure to furnish correct payee statements.

If you fail to provide correct payee statements (Forms W-2) to your employees and cannot show reasonable cause, you may be subject to a penalty as provided under section 6722. The penalty applies if you fail to provide the statement by January 31, 2020, if you fail to include all information required to be shown on the statement, or if you include incorrect information on the statement.

The amount of the penalty is based on when you furnish the correct payee statement. This penalty is an additional penalty and is applied in the same manner, and with the same amounts, as in Failure to file correct information returns by the due date.

Newfront 2020 Go All the Way With HSA Guide

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn