HSA Establishment Date

By Brian Gilmore | Published December 6, 2019

**Question: **When is an HSA established?

**Short Answer: **The general rule is that an HSA is established when it is first funded, and individuals cannot take a tax-free distribution for medical expenses incurred prior to the HSA establishment date.

-

General HSA Establishment Rule: Ability to Incur Expenses That are Eligible for Tax-Free Medical Distributions Does Not Begin Until HSA is Funded

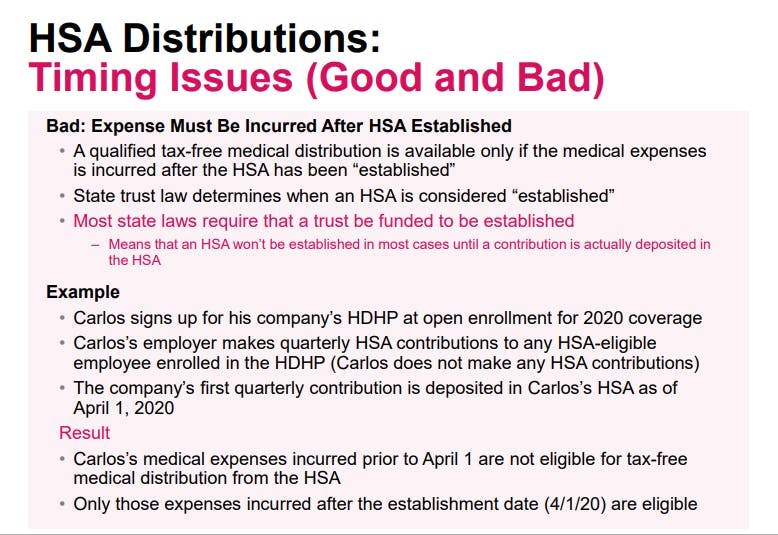

Individuals may take a qualified tax-free medical distribution from an HSA only for medical expenses incurred after the individual established the HSA.

State trust law determines when an HSA is considered “established.” Most state laws require that a trust be funded to be established. This means that in most cases an HSA is not established until a contribution is deposited.

Example 1:

– Aaron is hired November 15 by Cheese heads, Inc. with date of hire coverage.

– Aaron enrolls in the company’s HDHP medical plan option.

– Aaron did not establish an HSA previously.

– On November 20, Aaron incurs $250 in deductible expenses under the Cheese heads, Inc. HDHP medical plan option.

– The first deposit into Aaron’s HSA is made by Cheese heads, Inc. in December.

Result 1:

– Aaron’s HSA is established in December.

– Aaron cannot use the HSA to pay for his $250 deductible expenses on a tax-free basis because they were incurred prior to the December establishment of the HSA.

– Important Note: Aaron also is not HSA eligible (i.e., eligible to make or receive HSA contributions) in November because he was not covered by the HDHP as of the first day of the calendar month.

Special HSA Establishment Rule: Individuals Who Had an HSA in the Previous 18 Months

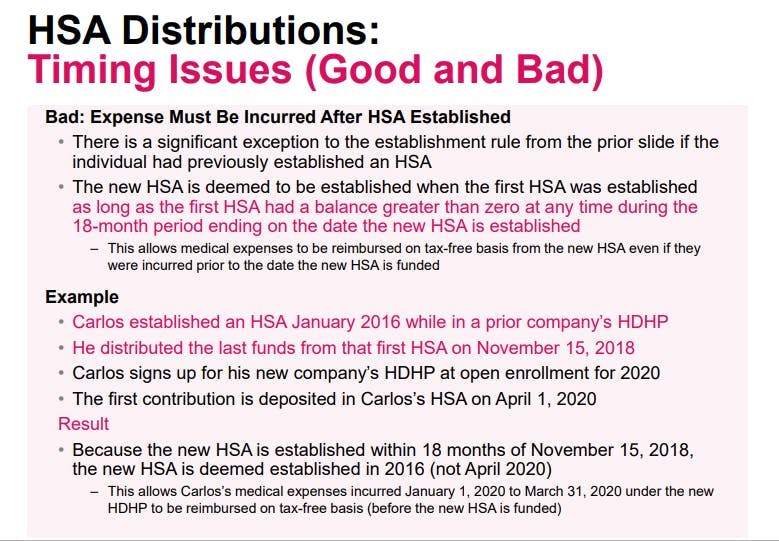

For individuals who previously had an HSA, there is a significant exception from the general rule that may permit individuals to take a tax-free medical distribution prior to the date the new HSA is funded.

The special rule provides that the new HSA is deemed to be established when the first HSA was established as long as the individual had an HSA with a balance greater than zero at any time during the 18-month period ending on the date the new HSA is established.

Example 2:

– Aaron is hired November 15, 2019 by Cheese heads, Inc. with date of hire coverage.

– Aaron enrolls in the company’s HDHP medical plan option.

– Aaron had an HSA previously that was established January 2016.

– Aaron distributed the last funds from that previous HSA on July 4, 2018.

– On November 20, Aaron incurs $250 in deductible expenses under the Cheese heads, Inc. HDHP medical plan option.

– The first deposit into Aaron’s new HSA is made by Cheese heads, Inc. in December 2019.

Result 2:

– Aaron funded his new HSA within 18 months of the date he last had a balance in his prior HSA (July 4, 2018).

– Aaron’s new HSA is therefore deemed established January 2016 (not December 2019).

– Aaron can use the new HSA to pay for his $250 deductible expenses on a tax-free basis because they were incurred after the new HSA’s deemed establishment date in January 2016.

For more details on everything HSA, see our Newfront Go All the Way With HSA Guide.

Regulations

IRC §223(c)(1)(A):

(1) Eligible individual.

(A) In general. The term “eligible individual” means, with respect to any month, any individual if—

_**(i) such individual is covered under a high deductible health plan as of the 1st day of such month, **_and

(ii) such individual is not, while covered under a high deductible health plan, covered under any health plan—

(I) which is not a high deductible health plan, and

(II) which provides coverage for any benefit which is covered under the high deductible health plan.

IRS Notice 2004-2:

https://www.irs.gov/pub/irs-drop/n-04-2.pdf

Q-2. Who is eligible to establish an HSA?

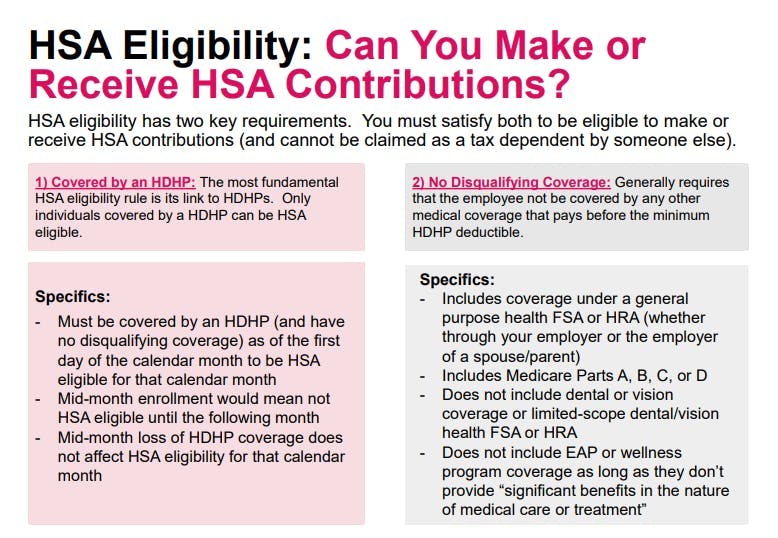

A-2. An “eligible individual” can establish an HSA. An “eligible individual” means, with respect to any month, any individual who: (1) is covered under a high-deductible health plan (HDHP) on the first day of such month; (2) is not also covered by any other health plan that is not an HDHP (with certain exceptions for plans providing certain limited types of coverage); (3) is not enrolled in Medicare (generally, has not yet reached age 65); and (4) may not be claimed as a dependent on another person’s tax return.

…

Q-26. What are the “qualified medical expenses” that are eligible for tax-free distributions?

A-26. The term “qualified medical expenses” are expenses paid by the account beneficiary, his or her spouse or dependents for medical care as defined in section 213(d) (including nonprescription drugs as described in Rev. Rul. 2003-102, 2003-38 I.R.B. 559), but only to the extent the expenses are not covered by insurance or otherwise. The qualified medical expenses must be incurred only after the HSA has been established. For purposes of determining the itemized deduction for medical expenses, medical expenses paid or reimbursed by distributions from an HSA are not treated as expenses paid for medical care under section 213.

IRS Notice 2008-59:

https://www.irs.gov/pub/irs-drop/n-08-59.pdf

Q-38. When is an HSA established?

A-38. An HSA is an exempt trust established through a written governing instrument under state law. Section 223(d)(1). State trust law determines when an HSA is established. Most state trust laws require that for a trust to exist, an asset must be held in trust; thus, most state trust laws require that a trust must be funded to be established. Whether the account beneficiary’s signature is required to establish the trust also depends on state law.

…

Q-41. On what date is an HSA established if the account beneficiary had previously established an HSA?

A-41. If an account beneficiary establishes an HSA, and later establishes another HSA, any later HSA is deemed to be established when the first HSA was established if the account beneficiary has an HSA with a balance greater than zero at any time during the 18-month period ending on the date the later HSA is established.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn