HSA Distributions for Premium Expenses

By Brian Gilmore | Published March 27, 2020

**Question: **When can an individual take a tax-free HSA distribution for premium expenses?

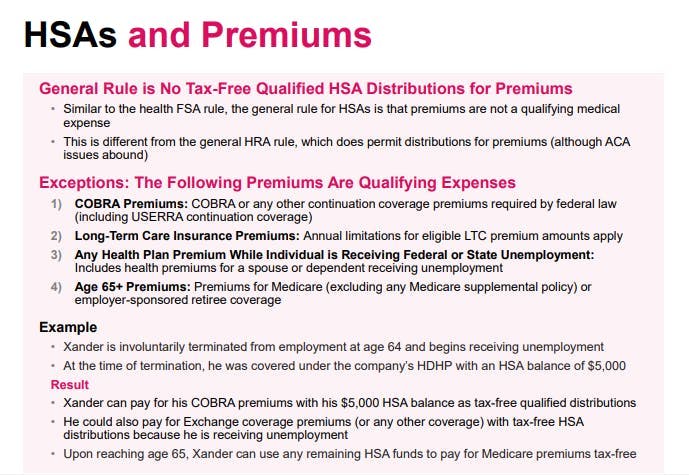

**Short Answer_:_ **Premium payments generally are not a qualified medical expense for HSA purposes, but there are four significant exceptions where tax-free distributions are permitted.

General Rule: Expenses Must Qualify as §213(d) Medical Expenses

HSAs can reimburse only IRC §213(d) qualified medical expenses on a tax-free basis. The best general IRS overview of what constitutes a §213(d) medical expense is IRS Publication 502.

Most Premium Expenses are Not HSA Qualified Medical Expenses

Although in almost all circumstances the Publication 502 list of §213(d) medical expenses mirrors those expenses eligible for tax-free HSA distributions, there are a few differences. The slight modifications to the list of reimbursable expenses for account-based plans are set forth in IRS Publication 969.

The most significant discrepancy is the general exclusion of premium expenses from the list of HSA qualified medical expenses eligible for tax-free reimbursement. Except in the four limited situations described below, use of an HSA to pay for premium expenses would be a non-medical distribution subject to income taxes and (if under age 65) a 20% additional tax.

Exception #1: Long-Term Care Insurance Premiums

Individuals can take tax-free HSA distributions to pay for long-term care policy premiums, but only up to a limit that is based on age that adjusts annually.

The annual cap on tax-free HSA distributions for long-term care insurance premiums is as follows in 2020:

Age 40 or under: $430

Age 41 to 50: $810

Age 51 to 60: $1,630

Age 61 to 70: $4,350

Age 71 and over: $5,430

Exception #2: COBRA Premiums

Individuals can take tax-free HSA distributions for COBRA premiums or any other continuation coverage premiums required by federal law (e.g., USERRA).

Exception #3: Any Health Plan Premium While Individual is Receiving Federal or State Unemployment

Individuals who are receiving unemployment under federal or state law can take tax-free HSA distributions to pay for any health plan premium, including individual coverage purchased on the exchange.

Exception #4: Medicare Premiums

Individuals who have reached age 65 can take tax-free HSA distributions for Medicare, an employer-sponsored retiree plan, or any other health coverage.

Important limitation: Medicare supplemental policy premiums (such as Medigap) do not qualify for tax-free HSA distributions.

What the Future Holds

There are movements both to expand and restrict the ability to use HSAs to pay for premium expenses on a tax-free basis.

For more details on everything ACA, see our Newfront Go All the Way With HSA Guide.

Regulations

IRC §223(d)(2)(B):

(2) Qualified medical expenses.

(A) In general. The term “qualified medical expenses” means, with respect to an account beneficiary, amounts paid by such beneficiary for medical care (as defined in section 213(d)) for such individual, the spouse of such individual, and any dependent (as defined in section 152, determined without regard to subsections (b)(1), (b)(2) , and (d)(1)(B) thereof) of such individual, but only to the extent such amounts are not compensated for by insurance or otherwise. Such term shall include an amount paid for medicine or a drug only if such medicine or drug is a prescribed drug (determined without regard to whether such drug is available without a prescription) or is insulin.

(B) Health insurance may not be purchased from account. Subparagraph (A) shall not apply to any payment for insurance.

(C) Exceptions. Subparagraph (B) shall not apply to any expense for coverage under—

(i) a health plan during any period of continuation coverage required under any Federal law,

(ii) a qualified long-term care insurance contract (as defined in section 7702B(b)),

(iii) a health plan during a period in which the individual is receiving unemployment compensation under any Federal or State law, or

(iv) in the case of an account beneficiary who has attained the age specified in section 1811 of the Social Security Act, any health insurance other than a medicare supplemental policy (as defined in section 1882 of the Social Security Act).

IRS Publication 969:

https://www.irs.gov/pub/irs-pdf/p969.pdf

Distributions From an HSA

You generally will pay medical expenses during the year without being reimbursed by your HDHP until you reach the annual deductible for the plan. When you pay medical expenses during the year that aren’t reimbursed by your HDHP, you can ask the trustee of your HSA to send you a distribution from your HSA.

You can receive tax-free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA. If you receive distributions for other reasons, the amount you withdraw will be subject to income tax and may be subject to an additional 20% tax. You don’t have to make withdrawals from your HSA each year.

…

Insurance premiums.

You can’t treat insurance premiums as qualified medical expenses unless the premiums are for:

Long-term care insurance.

Health care continuation coverage (such as coverage under COBRA).

Health care coverage while receiving unemployment compensation under federal or state law.

Medicare and other health care coverage if you were 65 or older (other than premiums for a Medicare supplemental policy, such as Medigap).

The premiums for long-term care insurance (item (1)) that you can treat as qualified medical expenses are subject to limits based on age and are adjusted annually. See Limit on long-term care premiums you can deduct in the instructions for Schedule A (Form 1040).

Items (2) and (3) can be for your spouse or a dependent meeting the requirement for that type of coverage. For item (4), if you, the account beneficiary, aren’t 65 or older, Medicare premiums for coverage of your spouse or a dependent (who is 65 or older) generally aren’t qualified medical expenses.

IRS Notice 2004-2:

https://www.irs.gov/irb/2004-02_IRB#NOT-2004-2

Q-27. Are health insurance premiums qualified medical expenses?

A-27. Generally, health insurance premiums are not qualified medical expenses except for the following: qualified long-term care insurance, COBRA health care continuation coverage, and health care coverage while an individual is receiving unemployment compensation. In addition, for individuals over age 65, premiums for Medicare Part A or B, Medicare HMO, and the employee share of premiums for employer-sponsored health insurance, including premiums for employer-sponsored retiree health insurance can be paid from an HSA. Premiums for Medigap policies are not qualified medical expenses.

IRS Notice 2008-59:

https://www.irs.gov/pub/irs-drop/n-08-59.pdf

Q-32. Are premiums for health coverage for a spouse or dependent during a period when the spouse or dependent is receiving unemployment compensation under any Federal or state law qualified medical expenses?

A-32. Yes. Although qualified medical expenses generally exclude payments for insurance, § 223(d)(2)(C)(iii) provides an exception for the expense of coverage under a health plan during a period in which an individual is receiving unemployment compensation under any Federal or state law.

IRS Revenue Procedure 2019-44:

https://www.irs.gov/pub/irs-drop/rp-19-44.pdf

.28 Eligible Long-Term Care Premiums. For taxable years beginning in 2020, the limitations under § 213(d)(10), regarding eligible long-term care premiums includible in the term “medical care,” are as follows:

Attained Age Before the Close of the Taxable Year

40 or less $430

More than 40 but not more than 50 $810

More than 50 but not more than 60 $1,630

More than 60 but not more than 70 $4,350

More than 70 $5,430

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn