How ACA Affects Flex Credits

By Brian Gilmore | Published June 14, 2019

Question: What are some of the main compliance considerations for employers that are implementing a flex credit contribution approach?

Compliance Team Response:

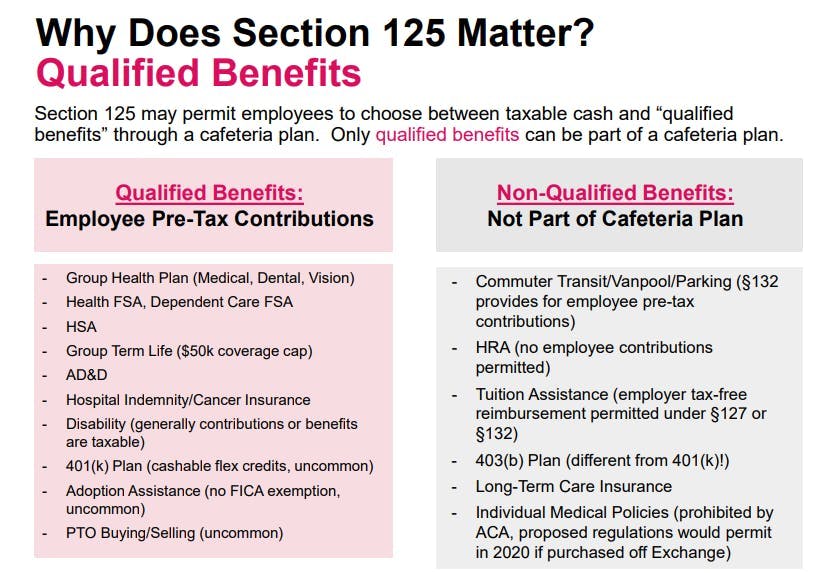

Flex credits are a feature available under a Section 125 cafeteria plan for employers to provide a defined contribution amount that employees may allocate among various qualified benefits.

Employers enjoy a considerable amount of flexibility in determining how to design a flex credit approach. For example, employers may design flex credits to be cashable (i.e., the employee may allocate the credits toward standard taxable wages) or non-cashable (i.e., flex credits not allocated to benefit contributions will be retained by the employer).

However, there are some important compliance considerations to be aware of when designing a flex credit approach, which have increased in complexity under the ACA.

Here are the top three compliance issues to consider when deciding how to structure flex credits under a cafeteria plan:

1. ACA Affordability

The ACA affordability rules provide that the employee-share of the premium for employee-only coverage under an ALE’s lowest-cost plan option in which the employee is eligible to enroll (that provides minimum value) cannot exceed 9.86% (2019 indexed level) of the employee’s income under one of three safe harbor approaches.

Flex credits will reduce the dollar amount of the employee-share of the premium for the cheapest plan option providing minimum value that is used to determine affordability only if they meet a three-part test to qualify as a “health flex contribution”:

The employee may not opt to receive the amount as a taxable benefit (i.e., it is not a cashable flex credit);

The employee may use the amount to pay for minimum essential coverage (i.e., the employer’s major medical plan); and

The employee may use the amount exclusively for 213(d) health coverage costs (e.g., medical, dental, vision, health FSA).

Action Item: If you offer a defined contribution-style flex credit approach to employees, make sure that a sufficient portion is designated as “health flex contributions” to qualify under an ACA affordability safe harbor. This will require at least some of the flex credits to be non-cashable and designated for health plan purposes only.

2. ACA Health FSA Limitation

Health FSAs must be considered an “excepted benefit” to avoid violating the ACA market reform provisions.

The general requirements for a health FSA to be considered an excepted benefit (and therefore not subject to the ACA market reform provisions) are:

The Footprint Rule: All employees eligible for the health FSA must also be eligible for the major medical plan; and

The $500 Rule: Employer non elective contributions to the health FSA cannot exceed $500.

Flex credits are treated as follows for these purposes:

a. Cashable Flex Credits: Employee Salary Reduction Contributionb. Non-Cashable Flex Credits: Employer Contribution

Therefore, in almost all cases the maximum health FSA amount available for plan years beginning on or after January 1, 2019 is limited to $2,700 (max employee salary contribution, including cashable flex credits) + $500 (max employer contribution, including non-cashable flex credits) = $3,200 (combined).

The ACA has rendered non-excepted health FSAs unlawful and subject to $100/day/employee penalties under IRC §4980D for violation of the ACA market reforms

Action Item: No more than $500 of the flex credits from the “health flex contribution” bucket can be available to employees to allocate to the health FSA. Flex credits allocated to the health FSA from a separate bucket of cashable flex credits can be applied to the full $2,700 salary reduction contribution limit.

For more details:

2019 Health FSA Limit Increased to $2,700

401(k) Flex Credits

One interesting and often overlooked cafeteria plan feature is that 401(k) plans are a qualified benefit. This feature’s only real purpose is to permit employees to allocate flex credit amounts to 401(k) plan deferrals.

However, this 401(k) plan deferral option is available only with respect to cashable flex credits. Employees cannot allocate non-cashable flex credits to a 401(k) plan (because that would not be a cash or deferred arrangement).

Action Item: Employers cannot permit employees to allocate amounts from the “health flex contribution” bucket toward 401(k) deferrals because such credits are not cashable. Employees can use a separate bucket of cashable flex credits to increase their 401(k) plan deferrals.

Summary

Employers offering a defined contribution flex credit approach should consider making available at least two different buckets of the credits to employees:

A bucket meeting the requirements of a “health flex credit contribution” for ACA affordability purposes; and

A bucket of cashable flex credits to permit employees to contribute more than $500 to the health FSA and to permit 401(k) deferrals.

Newfront Office Hours Webinar: Section 125 Cafeteria Plans

Regulations

IRS Notice 2015-87:

https://www.irs.gov/pub/irs-drop/n-15-87.pdf

Under a § 125 cafeteria plan, the employee’s enrollment in a group health plan generally is funded by salary reduction but may also be funded by employer flex contributions. Whether these employer flex contributions reduce the amount of an employee’s required contribution depends on the nature of the available flex contribution. Specifically, the amount of the employer contribution reduces the employee’s required contribution if the amount constitutes a “health flex contribution” under §§ 1.5000A-3(e)(3)(ii)(E) and 1.36B-2(c)(3)(v)(A)(6). Sections 1.5000A3(e)(3)(ii)(E) and 1.36B-2(c)(v)(A)(6) provide that an amount is a health flex contribution if (1) the employee may not opt to receive the amount as a taxable benefit, (2) the employee may use the amount to pay for minimum essential coverage, and (3) the employee may use the amount exclusively to pay for medical care, within the meaning of § 213. For purposes of § 4980H(b) and the related reporting under § 6056 (Form 1095-C), a health flex contribution is treated as made ratably for each month of the period to which it relates.

IRS Notice 2012-40:

https://www.irs.gov/irb/2012-26_IRB

As noted, the $2,500 limit applies only to salary reduction contributions and not to employer non-elective contributions, sometimes called flex credits. Generally, an employer may make flex credits available to an employee who is eligible to participate in the cafeteria plan, to be used (at the employee’s election) only for one or more qualified benefits. For further information on flex credits, see Prop. Treas. Reg. § 1.125-5(b).** For example, if an employer contributes a $500 flex credit to each employee’s health FSA for the 2013 plan year, each employee may still elect to make salary reduction contributions of $2,500 (as indexed for inflation) to a health FSA for that plan year. However, if an employer provides flex credits that employees may elect to receive as cash or as a taxable benefit, those flex credits are treated as salary reduction contributions for purposes of § 125(i).**

29 CFR §2590.732(c)(3)(v)(B):

(c) Excepted benefits.

…

(v) Health flexible spending arrangements. Benefits provided under a health flexible spending arrangement (as defined in section 106(c)(2)) are excepted for a class of participants only if they satisfy the following two requirements—

(A) Other group health plan coverage, not limited to excepted benefits, is made available for the year to the class of participants by reason of their employment; and

(B) The arrangement is structured so that the maximum benefit payable to any participant in the class for a year cannot exceed two times the participant’s salary reduction election under the arrangement for the year (or, if greater, cannot exceed $500 plus the amount of the participant’s salary reduction election). For this purpose, any amount that an employee can elect to receive as taxable income but elects to apply to the health flexible spending arrangement is considered a salary reduction election (regardless of whether the amount is characterized as salary or as a credit under the arrangement).

DOL Technical Release 2013-3:

https://www.dol.gov/agencies/ebsa/employers-and-advisers/guidance/technical-releases/13-03

2. Application of the Market Reforms to Certain Health FSAs

Question 7: How do the market reforms apply to a health FSA that does not qualify as excepted benefits?

Answer 7: The market reforms do not apply to a group health plan in relation to its provision of benefits that are excepted benefits. Health FSAs are group health plans but will be considered to provide only excepted benefits if the employer also makes available group health plan coverage that is not limited to excepted benefits and the health FSA is structured so that the maximum benefit payable to any participant cannot exceed two times the participant’s salary reduction election for the health FSA for the year (or, if greater, cannot exceed $500 plus the amount of the participant’s salary reduction election). See 26 C.F.R. §54.9831-1(c)(3)(v), 29 C.F.R. §2590.732(c)(3)(v), and 45 C.F.R. § 146.145(c)(3)(v). Therefore, a health FSA that is considered to provide only excepted benefits is not subject to the market reforms.

If an employer provides a health FSA that does not qualify as excepted benefits, the health FSA generally is subject to the market reforms, including the preventive services requirements. Because a health FSA that is not excepted benefits is not integrated with a group health plan, it will fail to meet the preventive services requirements.

IRC §4980D(b)(1):

(b) Amount of tax.

(1) In general.

The amount of the tax imposed by subsection (a) on any failure shall be $100 for each day in the noncompliance period with respect to each individual to whom such failure relates.

Treas. Reg. §1.401(k)-1(e)(2)(i):

(2) Election requirements.

(i) Cash must be available. A cash or deferred arrangement satisfies this paragraph (e) only if the arrangement provides that the amount that each eligible employee may defer as an elective contribution is available to the employee in cash. Thus, for example, if an eligible employee is provided the option to receive a taxable benefit (other than cash) or to have the employer contribute on the employee’s behalf to a profit-sharing plan an amount equal to the value of the taxable benefit, the arrangement is not a qualified cash or deferred arrangement. Similarly, if an employee has the option to receive a specified amount in cash or to have the employer contribute an amount in excess of the specified cash amount to a profit-sharing plan on the employee’s behalf, any contribution made by the employer on the employee’s behalf in excess of the specified cash amount is not treated as made pursuant to a qualified cash or deferred arrangement, but would be treated as a matching contribution. This cash availability requirement applies even if the cash or deferred arrangement is part of a cafeteria plan within the meaning of section 125.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn