Health FSA $500 Carryover Conditioned on New Plan Year Election

By Brian Gilmore | Published November 16, 2018

Question: Do employees need to make a new health FSA election for the upcoming plan year at open enrollment to have access to the $500 carryover?

Compliance Team Response:

Default Rule: Access to Health FSA Carryover Regardless of Subsequent Plan Year Election

For health FSAs that offer the $500 carryover, the default position is the employee will continue to have access to the carryover amount in subsequent plan years regardless of whether the employee elects to contribute to the health FSA again in the subsequent plan year.

Where the employee does not elect to contribute to the health FSA for the subsequent plan year, the employee would have access to only the carryover amount under the health FSA for the subsequent plan year.

Two Exceptions: Plan Terms May Limit Access to Health FSA Carryover

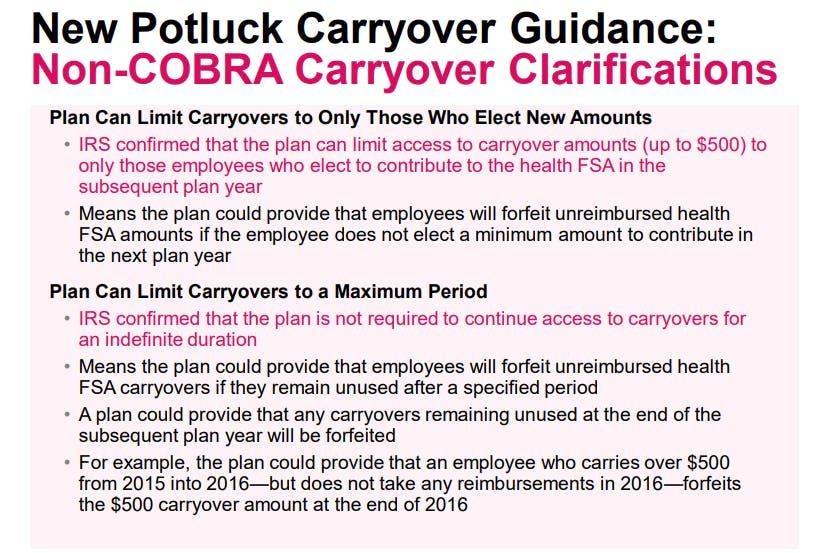

The IRS provided guidance in Notice 2015-87 (the “IRS ACA Potluck Guidance”) allowing the plan to impose two significant limitations on employees’ ability to access the health FSA carryover. As described above, the default position is that these limitations do not apply. Therefore, the employer would have to choose to impose these two limitations by including them in the health FSA component of Section 125 cafeteria plan.

The two potential limitations, if included in the terms of the plan, are:

Plan Terms May Condition Carryover On Subsequent Plan Year Health FSA Election

The plan may restrict carryover funds to only those employees who elect to contribute for the subsequent year. The plan terms may therefore provide that employees must make a minimum election of some amount (e.g., $100) to the health FSA for the subsequent plan year in order to participate and have access to the up to $500 carryover from the prior year.

In this situation, employees who do not make the minimum election to participate in the health FSA for the subsequent year will forfeit any unused amount at the end of the plan year and any associated run-out period. In other words, there will not be any carryover amount available in the subsequent plan year.

Plan Terms May Limit Carryover Duration to a Maximum Period

The plan may limit the maximum period that employees can carry over the (up to $500) balance of unreimbursed health FSA contributions. That maximum carryover duration could be as short as one plan year.

For example, take an employee who carries over $500 from the 2018 plan year into the 2019 plan year. If the plan imposed a one-year maximum carryover duration, any remaining balance of the $500 carryover would forfeit at the end of the 2019 plan year and any associated run-out period. In other words, no amount of the $500 carried over from the 2018 plan year into the 2019 plan year would continue be available into the 2020 plan year.

IRS Notice 2015-87:

https://www.irs.gov/pub/irs-drop/n-15-87.pdf

Question 24: May a health FSA condition the ability to carry over unused amounts on participation in the health FSA in the next year?

Answer 24: Yes. A health FSA may limit the availability of the carryover of unused amounts (subject to the $500 limit) to individuals who have elected to participate in the health FSA in the next year, even if the ability to participate in that next year requires a minimum salary reduction election to the health FSA for that next year.

Example. Facts: Employer sponsors a cafeteria plan offering a health FSA that permits up to $500 of unused health FSA amounts to be carried over to the next year in compliance with Notice 2013-71, but only if the employee participates in the health FSA during that next year. To participate in the health FSA, an employee must contribute a minimum of $60 ($5 per calendar month). As of December 31, 2016, Employee A and Employee B each have $25 remaining in their health FSA. Employee A elects to participate in the health FSA for 2017, making a $600 salary reduction election. Employee B elects not to participate in the health FSA for 2015. Employee A has $25 carried over to the health FSA for 2017, resulting in $625 available in the health FSA. Employee B forfeits the $25 as of December 31, 2016 and has no funds available in the health FSA thereafter.

Conclusion: This arrangement is a permissible health FSA carryover feature under Notice 2013-71.

Question 25: May a health FSA limit the ability to carry over unused amounts to a maximum period?

Answer 25: Yes. A health FSA may limit the ability to carry over unused amounts to a maximum period (subject to the $500 limit). For example, a health FSA can limit the ability to carry over unused amounts to one year. Thus, if an individual carried over $30 and did not elect any additional amounts for the next year, the health FSA may require forfeiture of any amount remaining at the end of that next year.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn