Form 5500 Small Plan Exemption

By Brian Gilmore | Published November 2, 2018

Question: When does the Form 5500 small plan exemption apply? What are the potential penalties for a late Form 5500 filing if the employer did not meet the exemption?

Compliance Team Response:

Form 5500 Small Plan Exemption

The small plan Form 5500 exemption applies for plans with fewer than 100 covered “participants” on the first day of the plan year. “Participant” refers to the employees (or former employees on COBRA) covered under the plan only. It does not include spouses and dependents.

Keep in mind though that “covered participants” technically includes any ERISA benefit—not just medical/dental/vision. For example, if the employer had at least 100 employees covered by a group term life insurance plan or a disability/AD&D plan on the first day of the plan year, it would still be required to file.

Note that for ERISA purposes, there is typically only one plan for all of the health and welfare plan benefits. This is the plan 501 governed by the wrap plan document and filed as one 5500. The fact that only one benefit within the plan had more than 100 enrolled does not matter. For ERISA purposes, this is viewed as the entire “mega” wrap H&W plan (i.e., medical, dental, vision, life, disability, AD&D, etc.) having more than 100 enrolled.

If required, the Form 5500 is due by the last day of the 7th month after the end of the plan year. A 2 ½ month extension is available by filing Form 5558 prior to the applicable deadline.

Note: The small plan exemption never applies for a 401(k) plan. This exemption is relevant only for health and welfare plans that are not a MEWA and are not funded by a trust.

Form 5500 Late Filing Penalties

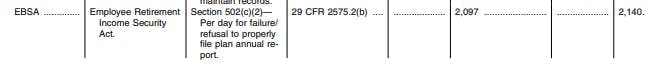

The penalty for failure to timely file a 2017 Form 5500 is up to $2,097 per day that the filing is late. The amount is indexed to increase each year for inflation (up to $2,140 per day for 2018).

DFVCP: Reduced Penalty for Late Filings

Employers that file late Forms 5500 through the DOL’s Delinquent Filer Voluntary Compliance Program (DFVCP)—prior to the issue being discovered by the DOL—will avoid those (potentially very large) late filing penalties. DFVCP offers a much reduced penalty amount that is calculated through a DOL site: https://www.askebsa.dol.gov/dfvcepay/calculator.

The DFVCP fee is $10 per day late (based on the original deadline, not the extended deadline), capped at $2,000 per year. There is a $4,000 overall per plan cap for multiple late filings under the same plan.

Regulations

29 CFR § 2520.104-20(b):

(b) Application.

This exemption applies only to welfare benefit plans—

(1) Which have fewer than 100 participants at the beginning of the plan year;

(2) (i) For which benefits are paid as needed solely from the general assets of the employer or employee organization maintaining the plan, or

(ii) The benefits of which are provided exclusively through insurance contracts or policies issued by an insurance company or similar organization which is qualified to do business in any State or through a qualified health maintenance organization as defined in section 1310(d) of the Public Health Service Act, as amended, 42 USC 300e-9(d) , the premiums for which are paid directly by the employer or employee organization from its general assets or partly from its general assets and partly from contributions by its employees or members, _provided, _That contributions by participants are forwarded by the employer or employee organization within three months of receipt, or

(iii) Both;

(3) For which, in the case of an insured plan—(i) Refunds, to which contributing participants are entitled, are returned to them within three months of receipt by the employer or employee organization, and

(ii) Contributing participants are informed upon entry into the plan of the provisions of the plan concerning the allocation of refunds; and

(4) Which are not subject to the Form M-1 requirements under §2520.101-2 (Filing by Multiple Employer Welfare Arrangements and Certain Other Related Entities).

DOL Form 5500 Instructions:

Do Not File a Form 5500 for a Welfare Benefit Plan That Is Any of the Following:

A welfare benefit plan that covered fewer than 100 participants as of the beginning of the plan year and is unfunded, fully insured, or a combination of insured and unfunded, and which is not subject to the Form M-1 requirements under § 2520.101-2, as specified in 29 CFR 2520.104-20.

…

Administrative Penalties

Listed below are various penalties under ERISA and the Code that may be assessed or imposed for not meeting the annual return/report filing requirements. Generally, whether the penalty is under ERISA or the Code, or both, depends upon the agency for which the information is required to be filed. One or more of the following administrative penalties may be assessed or imposed in the event of incomplete filings or filings received after the due date unless it is determined that your failure to file properly is for reasonable cause:

A penalty of up to $2,097 a day for each day a plan administrator fails or refuses to file a complete and accurate report. See ERISA section 502(c)(2), 29 CFR 2560.502c-2, and the Federal Civil Penalties Inflation Adjustment Act of 1990, as amended by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (2015 Inflation Adjustment Act). Pub. L. No. 114-74; 129 Stat. 599 and the DOL’s implementing regulation at 82 FR 5373 (Jan. 18, 2017). The 2015 Inflation Adjustment Act requires agencies to adjust the levels of civil monetary penalties with an initial catch-up adjustment, followed by annual adjustments for inflation. Because the Federal Civil Penalties Inflation Adjustment Improvements Act of 2015 (Pub. L. No. 114-74; 129 Stat. 599), requires the penalty amount to be adjusted annually after the Form 5500 and its schedules, attachments, and instructions are published for filing, be sure to check DOL’s website for any possible required inflation adjustments of the maximum penalty amount that may have been published in the Federal Register after the instructions have been posted.

DOL DFVCP FAQ:

Large Plan Filers. In the case of a plan with 100 or more participants at the beginning of the plan year and which is not eligible for the 80/120 participant rule (hereinafter large plan), the applicable penalty amount is $10 per day for each day the annual report is filed after the date on which the annual report was due (without regard to any extensions), not to exceed $2,000. In the case of a DFVCP submission relating to more than one delinquent filing for the same plan, the maximum penalty amount is $2,000 for each annual report, not to exceed $4,000 per plan. Filers submitting to the DFVCP electronically must include information for all filings in the same online transaction in order for the penalty cap to apply. Similarly, all paper submissions to the DFVCP must be included in the same envelope or package to ensure that those filings count towards the per-plan capped penalty amount.

83 Fed. Reg. 7, 15 (Jan. 2, 2018):

https://www.gpo.gov/fdsys/pkg/FR-2018-01-02/pdf/2017-28224.pdf

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn