Eligibility of Parents for a Group Health Plan

By Brian Gilmore | Published April 7, 2017

In the U. S., parents are never eligible dependents under a group health plan.

Question: I know that employees cannot enroll their parents in the health plan even if they are a tax dependent or have a mid-year event. But what is the technical reason why?

Compliance Team Answer:

Parents Not Eligible

Health plans do not include parents as eligible dependents.

Plans almost uniformly limit eligibility coverage to:

The employee;

Spouse/domestic partner; and

Children under age 26.

(Children include natural children, step-children, foster children, adopted children, and children placed with the employee for adoption. Some plans will also extend dependent eligibility to children under age 26 for whom the employee is a legal guardian.)

ERISA Requirement to Administer Plan in Accordance with Written Terms

Under ERISA, the plan must be maintained and administered according to its written terms.

For many reasons, there is almost zero chance that the written terms of any employer-sponsored group health plan (the wrap plan document, wrap SPD, EOC, policy, certificate, open enrollment materials, new hire materials, handbook, etc.) would include parents as eligible dependents. That would create a number of tax and coverage issues.

Although it is technically possible, I have never seen plan terms that provide for parents to be eligible dependents. The insurance carrier (or stop-loss provider if self-insured) would never agree to it.

No HIPAA Special Enrollment Rights for Parents

The HIPAA special enrollment rights require plans to permit mid-year enrollment in the medial plan for employees and certain dependents upon the occurrence of a special enrollment event (marriage, birth/adoption/placement for adoption, loss of eligibility for other coverage, Medicaid/CHIP event).

These HIPAA special enrollment rights are specifically limited to individuals who are eligible under the terms of the plan. Therefore, there is no argument that any event that would otherwise require the plan to offer coverage mid-year to a spouse or child would apply to any other individual (such as a parent).

Account-Based Plans (Health FSA, HSA, HRA)

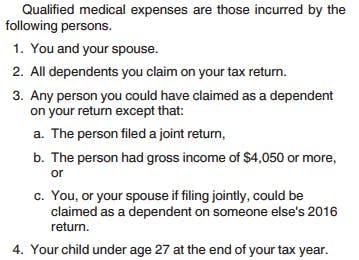

Tax-dependent status is relevant for determining whether the employee can reimburse out-of-pocket medical expenses from an account-based plan.

If the employee is enrolled in the health FSA or has money in an HSA, those funds could be used for a parent’s out-of-pocket medical expenses if the parent is a tax dependent under §105(b) (see below for definition).

If the employee is enrolled in an HRA, it is possible (but unlikely) that the HRA would permit reimbursement for a tax-dependent parent.

Regulations:

ERISA §402(a):

(1) Every employee benefit plan shall be established and maintained pursuant to a written instrument. Such instrument shall provide for one or more named fiduciaries who jointly or severally shall have authority to control and manage the operation and administration of the plan.

29 CFR §2590.701-2 (HIPAA Special Enrollment):

Unless otherwise provided, the definitions in this section govern in applying the provisions of §§2590.701 through 2590.734.

Dependent means any individual who is or may become eligible for coverage under the terms of a group health plan because of a relationship to a participant.

IRS Publication 969 (Account-Based Plans):

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn