ACA Reporting Penalties

By Brian Gilmore | Published December 18, 2020

Question: What are the potential ACA reporting penalties for late or incorrect Forms 1094-C and 1095-C?

Short Answer: The general ACA reporting penalties are $280 for the late/incorrect Forms 1095-C furnished to employees, and $280 for the late/incorrect Forms 1094-C and 1095-C filed with the IRS. That comes to a total potential general penalty of $560 per employee, but exceptions may apply.

ACA Reporting: General Rule

The ACA requires Applicable Large Employers (ALEs) to report whether they offered minimum essential coverage that was affordable and provided minimum value to full-time employees. Employers with self-insured plans also report months of coverage for all enrolled individuals. ACA reporting for employers is generally handled via IRS Forms 1094-C and 1095-C.

For more details, including the applicable ACA reporting deadlines:

Last Call: Final 30-Day Extension for 2020 ACA Reporting Forms Furnished in 2021

Key Decision Points in ACA Reporting Vendor Setup Questionnaires

Newfront ACA Employer Mandate Pay or Play and ACA Reporting Guide

ACA Reporting Penalties: $280/Form Penalty, $560/Employee Penalty for Late/Incorrect Forms

The general potential late/incorrect ACA reporting penalties are $280 for the late/incorrect Forms 1095-C furnished to employees, and $280 for the late/incorrect Forms 1094-C and copies of the Forms 1095-C filed with the IRS.

That comes to a total potential general ACA reporting penalty of $560 per employee when factoring in both the late/incorrect Form 1095-C furnished to the employee and the late/incorrect copy of that Form 1095-C filed with the IRS.

The maximum penalty for a calendar year will not exceed $3,392,000 for late/incorrect furnishing or filing.

Reduced Penalties for Short Duration Failures

The IRS reduces that general penalty if the late/corrected forms are furnished/filed in certain time periods:

30-Day Correction: If corrected within 30 days of the due date, the per-return penalty is $50 (capped at $565,000).

August 1 Correction: If corrected by August 1, the per-return penalty is $110 (capped at $1,696,000).

As with the general penalties, each furnishing and filing failure is a separate penalty for the employee. The result is that these reduced penalties will often apply twice per employee—once for a late/incorrect furnishing to the employee and once for a late/incorrect filing with the IRS.

Potential Reduced or Eliminated Penalties for “Reasonable Cause” Failures

There is “reasonable cause” relief available that could potentially reduce or eliminate these ACA reporting penalties if the employer can show no willful neglect, that it acted in a responsible manner both before and after the failure occurred, and there were significant mitigating factors or events beyond its control.

Those requirements are set forth in Treas. Reg. §301.6724-1. IRS Publication 1586 includes a useful summary of the conditions to qualify for reasonable cause relief.

Potential Increased Penalties for Intentional Disregard

The employer is subject to a penalty of at least $560 per form (with no maximum penalty) if the IRS finds that it intentionally disregarded the filing or furnishing of the correct Forms 1094-C and 1095-C.

Good-Faith Efforts Standard

For all years of ACA reporting to date, the IRS has provided penalty relief in the form of a “good-faith efforts” standard for incorrect or incomplete information on the ACA reporting forms. This includes missing and inaccurate SSNs and DOBs, as well as other information (e.g., incorrect Form 1095-C Part II codes).

The relief from penalties applies where the employer:

Makes a good faith effort to comply (including whether the employer made reasonable efforts to prepare for reporting); and

Furnishes and files the ACA reporting forms by the applicable deadlines (including any extension made available for the year).

Accordingly, completing and timely furnishing/filing the Forms 1094-C and 1095-C by the applicable deadlines takes on an additional level of significance for each year the good-faith efforts standard remains in effect. The deadlines are crucial both to avoid potential penalties for late filing and to take advantage of the good-faith efforts standard for missing or incorrect information on the ACA reporting forms.

It is very likely that this ACA reporting season (2020 ACA reporting forms furnished and filed at the start of 2021) will be the last year for which the good faith standard will apply. Unless the IRS is persuaded by public comments to further extend the good faith relief, it will not apply for the 2021 ACA reporting forms furnished and filed at the start of 2022.

For more details, see our prior alert: Last Call: Final 30-Day Extension for 2020 ACA Reporting Forms Furnished in 2021

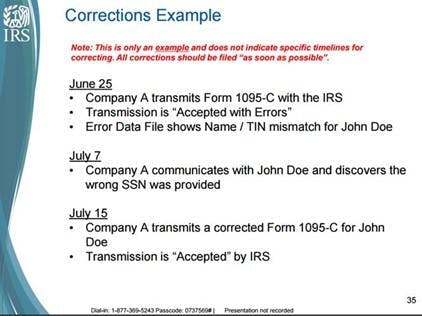

SSN Validations Errors

A common error employers receive when their vendor completes the ACA reporting is an IRS response in the validation process that certain SSNs do not match the IRS database of the employee’s or dependent’s name provided on the Form 1095-C.

Per the good-faith efforts standard described above, employers should make a good faith effort to obtain the correct names/SSNs, and re-file with the corrected information (if received) within a reasonable period. If the corrected names/SSNs are not received by the deadline, no penalties should apply as long as the company has made a good-faith effort to obtain them.

Note: It is not entirely clear that even this good faith effort is required for fully insured plans. Most of the IRS guidance is addressing SSN errors for dependents reported by the insurance carrier (Form 1095-B), or the employer where the plan is self-insured (Part III of the Form 1095-C in most cases).

Employers may need to file corrected forms for all individuals with this error in future years if the IRS does not continue to extend the good-faith enforcement rules. In that case, there are rules described above addressing reasonable cause for penalty relief (and reduced penalties regardless if re-filed within certain deadlines) that could also apply in this context.

Penalty Letters: IRS Notice 972CG (Late/Incorrect Filing)

Employers that do not timely file the ACA reporting forms will receive an IRS Notice 972CG informing them of the proposed penalties being imposed. Those penalties will track the amounts described above.

Employers have 45 days (60 days if outside the U.S.) to respond to the Notice 972CG either agreeing with the assessment and paying, or stating their reason they believe the penalties (in full or in part) should not apply. Employers that do not timely respond will receive a follow-up bill called a “Notice of Penalty Charge” that includes the penalties plus interest.

In most cases, the Notice 972CG will apply for late filings. Incorrect filings that were timely filed will typically be able to avoid penalties by virtue of the good-faith efforts standard described above.

Penalty Letters: IRS Letter 5699 (No Filing)

Employers that fail to file their ACA reporting forms will receive an IRS Letter 5699 asking the employer several questions related to why the forms have not been filed. Employers have 30 days to respond.

Penalty Letters: IRS Letters 226J and 227 (Employer Mandate Penalty)

If the IRS determines that the employer is subject to an ACA employer mandate penalty based on information included on the ACA reporting forms, the employer will receive an IRS Letter 226J describing the proposed §4980H penalty assessment.

Employers respond via Form 14764 (ESRP Response) agreeing or disagreeing with the penalty amount assessed by the listed response date. Employers disagreeing will include Form 14765 (PTC Listing) with their response indicating any changes needed to the Form 1095-C for employees who received exchange subsidies, as well as any supporting statement and/or documentation (e.g., employment or offer of coverage records) the employer would like to provide.

The IRS will respond to the employer response via a Letter 227, which comes in five different forms (227-J through 227-N). The Letter 227 will acknowledge the employer’s response and describe the applicable next steps in the process. Employers disagreeing with the Letter 227 will have the opportunity to request a conference with the supervisor of the IRS contact assessing the penalty and/or the IRS Independent Office of Appeals.

If the IRS ultimately determines at the end of the correspondence and/or appeals conference(s) that the employer owes the employer mandate penalty, the IRS will issue a Notice and Demand for payment via Notice CP220J. Interest will be charged on any outstanding balance until the amount is paid in full.

Letter 226J

IRS Letter 226J Overview: https://www.irs.gov/individuals/understanding-your-letter-226-j

IRS Sample Letter 226J: https://www.irs.gov/pub/notices/ltr226j.pdf

Letter 226J Response Forms

IRS Form 14764: https://www.irs.gov/pub/irs-pdf/f14764.pdf

IRS Form 14765: https://www.irs.gov/pub/irs-pdf/f14765.pdf

Letter 227

IRS Letter 227 Overview: https://www.irs.gov/individuals/understanding-your-letter-227

IRS Sample Letter 227-J: https://www.irs.gov/pub/notices/ltr227j.pdf

IRS Sample Letter 227-K: https://www.irs.gov/pub/notices/ltr227k.pdf

IRS Sample Letter 227-L: https://www.irs.gov/pub/notices/ltr227l.pdf

IRS Sample Letter 227-M: https://www.irs.gov/pub/notices/ltr227m.pdf

Notice CP220J

IRS Notice CP220J Overview: https://www.irs.gov/individuals/understanding-your-cp220j-notice

IRS Sample Notice CP220J: https://www.irs.gov/pub/notices/cp220j.pdf

IRC §6056 Non-Filer and IRC §4980H Compliance Process

IRS Internal Revenue Manual for Agents (25.21.4): https://www.irs.gov/irm/part25/irm_25-021-004

Regulations

IRS Forms 1094-C and 1095-C Instructions:

https://www.irs.gov/instructions/i109495c

Information reporting penalties.

All employers subject to the employer shared responsibility provisions and other employers that sponsor self-insured group health plans that fail to comply with the applicable information reporting requirements may be subject to the general reporting penalty provisions for failure to file correct information returns and failure to furnish correct payee statements. For returns required to be made and statements required to be furnished for 2020 tax year returns, the following apply.

The penalty for failure to file a correct information return is $280 for each return for which the failure occurs, with the total penalty for a calendar year not to exceed $3,392,000.

The penalty for failure to provide a correct payee statement is $280 for each statement for which the failure occurs, with the total penalty for a calendar year not to exceed $3,392,000.

However, no penalty will be imposed for failure to furnish a correct payee statement to an individual enrolled in an ALE Member’s self-insured health plan if (1) the individual is not a full-time employee for any month of 2020; (2) the ALE Member posts a notice prominently on its website that individuals may receive a copy of their 2020 Form 1095-C upon request; (3) the website provides an email address and a physical address to which a request may be sent and a telephone number that individuals can contact if they have questions; and (4) the ALE Member furnishes a 2020 Form 1095-C to any individual upon request within 30 days of the date the request is received. See Notice 2020-76.

Special rules apply that increase the per-statement and total penalties if there is intentional disregard of the requirement to file the returns and furnish the required statements.

No penalty will be imposed for reporting incorrect or incomplete information on the return or statement if the ALE Member can show that it made good-faith efforts to comply with the information reporting requirements. The IRS will take into account whether the ALE Member made reasonable efforts to prepare for reporting the required information to the IRS and furnishing it to employees such as gathering and transmitting the necessary data to an agent to prepare the data for submission to the IRS or testing the ALE Member’s ability to transmit information to the IRS. See Notice 2020-76.

Penalties may be waived if the failure was due to reasonable cause and not willful neglect. See section 6724 and Regulations section 301.6724-1 and Proposed Regulations section 1.6055-1(h) (which relate to Form 1095-C, Part III). For additional information, see Pub. 1586.

IRS Rev. Proc. 2019-44:

https://www.irs.gov/pub/irs-drop/rp-19-44.pdf

.57 Failure to File Correct Information Returns. In the case of any failure relating to a return required to be filed in 2021, the penalty amounts under § 6721 are:

(1) for persons with average annual gross receipts for the most recent three taxable years of more than $5,000,000, for failure to file correct information returns:

…

.58 Failure to Furnish Correct Payee Statements. In the case of any failure relating to a statement required to be furnished in 2021, the penalty amounts under § 6722 are:

(1) for persons with average annual gross receipts for the most recent three taxable years of more than $5,000,000, for failure to file correct information returns:

IRS Publication 1586:

https://www.irs.gov/pub/irs-pdf/p1586.pdf

III. REASONABLE CAUSE

To show that the failure to include a correct TIN was due to reasonable cause and not willful neglect, filers must establish that they acted in a responsible manner both before and after the failure occurred and that:

there were significant mitigating factors with respect to the failure (for example, an established history of filing information returns with correct TINs), or

the failure was due to events beyond the filer’s control (for example, actions of the payee or any other person).

Except as otherwise stated in this publication, acting in a responsible manner for missing and incorrect TINs generally includes making an initial solicitation (request) for the payee’s name and TIN and, if required, annual solicitations. Upon receipt of the newly provided TIN, it must be used on any future information returns filed. Refer to Treas. Reg. 301.6724-1 for all reasonable cause guidelines

IRS Notice 2020-76:

https://www.irs.gov/pub/irs-drop/n-19-63.pdf

Final Extension of Good-Faith Relief for Reporting and Furnishing under Sections 6055 and 6056 for 2020

This notice also provides a final extension of relief from penalties under sections 6721 and 6722 to reporting entities that report incorrect or incomplete information on the return or statement when these entities can show they made good-faith efforts to comply with the information-reporting requirements under sections 6055 and 6056 for 2020 (both for furnishing to individuals and for filing with the IRS). This relief applies to missing and inaccurate taxpayer identification numbers and dates of birth, as well as other information required on the return or statement. Reporting entities must make a good-faith effort to comply with the regulations under sections 6055 and 6056 to be eligible for this relief. In determining good faith, the IRS will take into account whether an employer or other coverage provider made reasonable efforts to prepare for reporting the required information to the IRS and furnishing it to employees and covered individuals, such as gathering and transmitting the necessary data to an agent to prepare the data for submission to the IRS or testing its ability to transmit information to the IRS. Reporting entities that fail to file an information return or furnish a statement by the extended due dates, except as otherwise provided in this notice, are not eligible for relief. As this good-faith relief was intended to be transitional relief, this is the last year the Treasury Department and the IRS intend to provide this relief.

IRS ACA Reporting Webinar:

https://www.irs.gov/pub/info_return/June_2016_Webinar_Presentation.pdf

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn