Potential ACA Employer Mandate Penalties for Late Offer of Coverage to New Full-Time Hire

By Brian Gilmore | Published October 4, 2019

Question: What are the potential ACA employer mandate penalties for failure to timely offer coverage to a new full-time hire (including a full-time temp or intern)?

Compliance Team Response:

-

Short Answer: The “B Penalty” ($312.50/month in 2019, $321.67/month in 2020) may apply for the failure to timely offer coverage to a new full-time hire.

General Rule: First Day of the Fourth Full Calendar Month

For new full-time hires, the general rule is that applicable large employers must offer coverage that is effective no later than the first day of the fourth full calendar month of employment to avoid potential ACA employer mandate pay or play penalties. Such new hires will need to be offered an “effective opportunity to elect to enroll” in coverage sufficiently in advance of that effective date for the offer of coverage to be valid.

Employers that offer coverage effective no later than the first day of the fourth full calendar month enjoy a limited non-assessment period to avoid potential ACA employer mandate penalties during the first three full calendar months of employment.

For more details on the requirements for offering coverage to new full-time hires, see our previous post: ACA Status for New Full-Time Hires.

Offering Coverage to a New Full-Time Hire After the First Day of the Fourth Full Calendar Month

Where the employer fails to offer coverage to a new full-time hire by the first day of the fourth full calendar month of employment, potential ACA employer mandate penalties apply. Because the employer missed this deadline, the limited non-assessment period (i.e., the grace period from potential ACA employ mandate penalties) for the first three full calendar months of employment does not apply.

The employer is therefore subject to potential ACA employer mandate penalties beginning with the first full calendar month of employment until the first day of the first full calendar month in which the employer has offered the employee an effective opportunity to enroll.

For more details on the options employers have in offering coverage to temps and interns, see our previous post: How the ACA Applies to Contingent Workers.

ACA Employer Mandate “A Penalty” Likely Does Not Apply

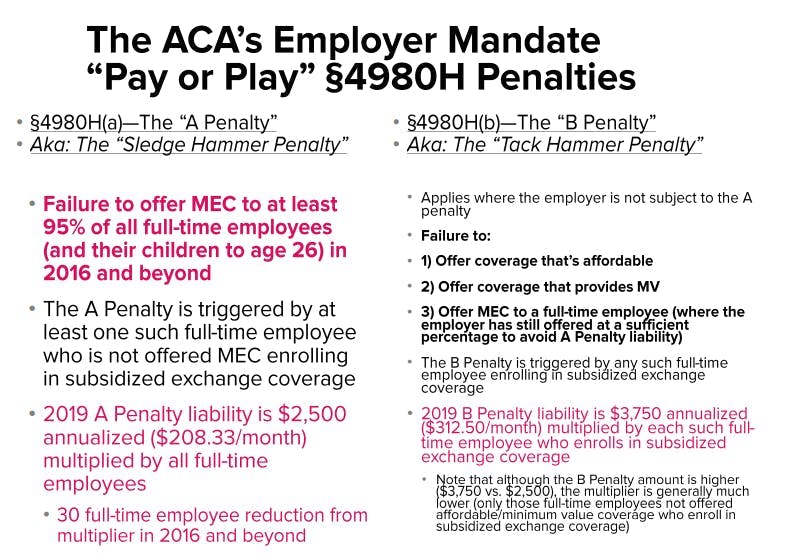

The ACA employer mandate’s large §4980H(a) penalty (frequently referred to as the “A Penalty” or the “Sledge Hammer Penalty”) applies where the ALE fails to offer minimum essential coverage to at least 95% of its full-time employees in any given calendar month.

The A Penalty is $208.33/month in 2019 or $214.17/month in 2020 multiplied by all full-time employees (reduced by the first 30). It is triggered by at least one full-time employee who was not offered minimum essential coverage enrolling in subsidized coverage on the Exchange.

Where the employer fails to timely offer coverage to only one new full-time hire, it is not a situation that will jeopardize the employer’s 95% offer of coverage threshold. Therefore, this one missed offer of coverage cannot create A Penalty liability.

However, it is crucial that employers maintain internal controls to ensure that they never are in a situation where an inadvertent failure to offer coverage to multiple new full-time hires by the end of the applicable limited non-assessment period results in an offer of coverage to less than 95% of the full-time workforce. Employers should never come close to utilizing the full 5% margin for error with respect to the A Penalty because the potential liability is so large.

ACA Employer Mandate “B Penalty” May Apply

The ACA employer mandate’s much smaller §4980(b) penalty (frequently referred to as the “B Penalty” or the “Tack Hammer Penalty”) applies where the ALE is not subject to the A Penalty (i.e., the ALE offers coverage to at least 95% of its full-time employees). It applies for each full-time employee who was not offered minimum essential coverage, offered unaffordable coverage, or offered coverage that did not provide minimum value and was enrolled in subsidized coverage on the Exchange.

The B Penalty is $312.50/month in 2019 or $321.67/month in 2020. Unlike the A Penalty, the B Penalty multiplier is only those full-time employees not offered coverage (or offered unaffordable or non-minimum value coverage) who actually enrolled in subsidized coverage on the Exchange. The multiplier is not all full-time employees.

In this case, the employer is potentially subject to B Penalties with respect to this full-time employee for each month (after the first partial month of employment, if any) that it failed to offer medical coverage. That B Penalty would apply if the employee was enrolled in subsidized Exchange coverage for any of such months. In other words, if the employee had coverage through a spouse, domestic partner, or parent’s employer-sponsored group health plan, no potential would apply.

Because the B Penalty is generally smaller than the employer-share of the premium if the employee were offered coverage and enrolled, employers should not be at all alarmed by the minimal potential B Penalty liability in this scenario. The main concern should be that the employer always maintains a comfortable margin over the 95% offer of coverage threshold to avoid potential A Penalty liability.

For more details on how employers are made aware of employee enrollment in subsidized Exchange coverage, see our previous post: Responding to Employer Notices from the Exchange.

Example of New Full-Time Employee Not Timely Offered Coverage

Example:

New full-time employee (including a temp or an intern) begins work on May 4

The employer realizes in October that it has not offered coverage yet to the new hire

Employer offers coverage in October for an effective date of November 1

Relevant Dates:

The first partial month of employment (May) is automatically a limited non-assessment period

The first three full calendar months of employment were June, July, and August

The first day of the fourth full calendar month of employment was September 1

ACA Employer Mandate Result:

Employer is subject to potential ACA employer mandate penalties for the months of June – October

Assuming the employer still offered coverage to at least 95% of full-time employees in those months, the A Penalty does not apply

The limited non-assessment period for the first three full calendar months of employment (June, July, August) does not apply because the employer failed to offer coverage by the first day of the fourth full calendar month of employment (i.e., did not offer coverage by September 1)

Potential B Penalty applies for June – October for the employer’s failure to offer coverage to the new full-time hire

Employer will be subject to the B Penalty ($312.50/month in 2019, $321.67/month in 2020) for those months if the employee was enrolled in subsidized Exchange coverage

ACA Reporting Form 1095-C Result:

May:

Line 14: 1H (No Offer of coverage)

Line 15: Blank

Line 16: 2D (Limited non-assessment period)

June – October:

Line 14: 1H (No Offer of coverage)

Line 15: Blank

Line 16: Blank (Note: 2D is not available for the first three full calendar months of this period because the employer did not offer coverage by the first day of the fourth full calendar month of employment–which was September 1)

Moving Forward

Upon discovering the error, the employer should offer medical coverage to the employee as soon as possible to avoid accumulating additional potential ACA employer mandate penalties. There is no retroactive way to address potential ACA employer mandate penalties for prior months.

The employer should also reassess its new hire practices, administration process, and enrollment systems to try to avoid new full-time hires (including temps, interns, or other contingent workers who are employees on the employer’s payroll) slipping through the cracks and inadvertently not timely receiving an offer of coverage.

Regulations

Newfront ACA Employer Mandate Pay or Play and ACA Reporting Guide

Treas. Reg. §54.4980H-3(d)(2)(iii):

(2) New non-variable hour, new non-seasonal and new non-part-time employees.

…

(iii) Application of section 4980H to initial full three calendar months of employment. Notwithstanding paragraph (d)(2)(i) of this section, with respect to an employee who is reasonably expected at his or her start date to be a full-time employee (and is not a seasonal employee), the employer will not be subject to an assessable payment under section 4980H(a) for any calendar month of the three-month period beginning with the first day of the first full calendar month of employment if, for the calendar month, the employee is otherwise eligible for an offer of coverage under a group health plan of the employer, provided that the employee is offered coverage by the employer no later than the first day of the fourth full calendar month of employment if the employee is still employed on that day. If the offer of coverage for which the employee is otherwise eligible during the first three full calendar months of employment, and which the employee actually is offered by the first day of the fourth month if still employed, provides minimum value, the employer also will not be subject to an assessable payment under section 4980H(b) with respect to that employee for the first three full calendar months of employment. For purposes of this paragraph (d)(2)(iii), an employee is otherwise eligible to be offered coverage under a group health plan for a calendar month if, pursuant to the terms of the plan as in effect for that calendar month, the employee meets all conditions to be offered coverage under the plan for that calendar month, other than the completion of a waiting period, within the meaning of §54.9801-2.

IRS Forms 1094-C and 1095-C Instructions:

https://www.irs.gov/instructions/i109495c

Limited Non-Assessment Period.

A Limited Non-Assessment Period generally refers to a period during which an ALE Member will not be subject to an assessable payment under section 4980H(a), and in certain cases section 4980H(b), for a full-time employee, regardless of whether that employee is offered health coverage during that period.

The first five periods described below are Limited Non-Assessment Periods with respect to sections 4980H(a) and 4980H(b) only if the employee is offered health coverage by the first day of the first month following the end of the period. Also, the first five periods described below are Limited Non-Assessment Periods for section 4980H(b) only if the health coverage that is offered at the end of the period provides minimum value. For more information on Limited Non-Assessment Periods and the application of section 4980H, see Regulations section 54.4980H-1(a)(26).

First year as ALE period. January through March of the first calendar year in which an employer is an ALE, but only for an employee who was not offered health coverage by the employer at any point during the prior calendar year.

Waiting period under the monthly measurement method. If an ALE Member is using the monthly measurement method to determine whether an employee is a full-time employee, the period beginning with the first full calendar month in which the employee is first otherwise (but for completion of the waiting period) eligible for an offer of health coverage and ending no later than two full calendar months after the end of that first calendar month.

Waiting period under the look-back measurement method. If an ALE Member is using the look-back measurement method to determine whether an employee is a full-time employee and the employee is reasonably expected to be a full-time employee at his or her start date, the period beginning on the employee’s start date and ending not later than the end of the employee’s third full calendar month of employment.

Initial measurement period and associated administrative period under the look-back measurement method. If an ALE Member is using the look-back measurement method to determine whether a new employee is a full-time employee, and the employee is a variable hour employee, seasonal employee or part-time employee, the initial measurement period for that employee and the administrative period immediately following the end of that initial measurement period.

Period following change in status that occurs during initial measurement period under the look-back measurement method. If an ALE Member is using the look-back measurement method to determine whether a new employee is a full-time employee, and, as of the employee’s start date, the employee is a variable hour employee, seasonal employee, or part-time employee, but, during the initial measurement period, the employee has a change in employment status such that, if the employee had begun employment in the new position or status, the employee would have reasonably been expected to be a full-time employee, the period beginning on the date of the employee’s change in employment status and ending not later than the end of the third full calendar month following the change in employment status. If the employee is a full-time employee based on the initial measurement period and the associated stability period starts sooner than the end of the third full calendar month following the change in employment status, this Limited Non-Assessment Period ends on the day before the first day of that associated stability period.

First calendar month of employment. If the employee’s first day of employment is a day other than the first day of the calendar month, then the employee’s first calendar month of employment is a Limited Non-Assessment Period.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn