ACA Employer Mandate and Reporting Rules When Acquiring a Non-ALE

By Brian Gilmore | Published September 6, 2019

Question: What are the ACA employer mandate and reporting requirements when an ALE acquires a non-ALE that keeps its EIN after the acquisition?

Short Answer: The non-ALE seller becomes subject to the ACA employer mandate and reporting requirements upon the acquisition by the ALE buyer.

“Applicable Large Employer” Status Includes Entire Controlled Group

The ACA employer mandate and reporting rules apply to employers that are “Applicable Large Employers,” or “ALEs.” In general, an employer is an ALE if it (along with all members in its controlled group) employed an average of at least 50 full-time employees, including full-time equivalent employees, on business days during the preceding calendar year.

For more details on determining ALE status generally, see our previous post: Becoming an ALE Subject to the ACA Employer Mandate and Reporting Requirements.

Seller Becomes an “Applicable Large Employer Member” Upon the Acquisition

Upon an ALE buyer acquiring a non-ALE small company seller, the small company becomes an “Applicable Large Employer Member,” or “ALEM,” of the buyer’s “Aggregated ALE Group.”

Subsidiaries and related entities in an ALE’s controlled group are referred to as ALEMs, and the controlled group itself is referred to as the Aggregated ALE group. So an ALE with multiple EINs in its controlled group is an Aggregated ALE Group consisting of multiple ALEMs.

That’s a jargon-filled way of saying that because ALE status is determined on the basis of the employer’s entire controlled group, the small company becomes subject to the ACA employer mandate pay or play rules and the associated ACA reporting requirements upon the acquisition. Furthermore, the small seller company is referred to as an ALEM of the broader Aggregated ALE Group because it is preserving its EIN as a member of the buyer’s controlled group.

In short, even if the previously non-ALE seller maintains its EIN, upon the close the acquisition the seller becomes an ALEM subject to:

Potential ACA employer mandate pay or play penalties, and

ACA reporting for the seller’s employees.

ACA Employer Mandate Penalty Structure Upon the Acquisition

The ACA employer mandate’s large §4980H(a) penalty (frequently referred to as the “A Penalty” or the “Sledge Hammer Penalty”) applies where the ALE fails to offer minimum essential coverage to at least 95% of its full-time employees in any given calendar month.

The 2019 A Penalty is projected to be $208.33/month ($2,500 annualized) multiplied by all full-time employees (reduced by the first 30). It is triggered by at least one full-time employee who was not offered minimum essential coverage enrolling in subsidized coverage on the Exchange.

Although ALE status is an aggregated count among all members of the controlled group, A Penalty calculations are siloed to each specific ALEM. When an employer acquires a new entity and preserves its EIN as a separate entity within the controlled group, the A Penalty 95% test applies to each ALEM independently.

In other words, if any ALEM fails to offer coverage to at least 95% of that particular ALEM’s full-time employees, the A Penalty applies to that particular ALEM. The A Penalty analysis is not applied over the full controlled group of full-time employees. Furthermore, if the ALEM is subject to the A Penalty, the 30-full-time employee reduction is adjusted to a proportional amount based on the ALEM’s size in relation to the entire Aggregated ALE Group.

Example:

ALE Big Co. (1,000 full-time employee) acquires non-ALE Lil’ Co. (40 full-time employees).

Big Co. and Lil’ Co. keep separate EINs and separate corporate entities after the close when Lil’ Co. joins the Big Co. controlled group.

Result:

Lil’ Co. becomes an ALE subject to the employer mandate upon the acquisition.

If Lil’ Co. fails to offer medical coverage to at least 95% of Lil’ Co.’s full-time employees in any subsequent month, Lil’ Co. will be subject to the A Penalty based only on the number of Lil’ Co.’s full-time employees (Big Co.’s full-time employees are not part of the calculation).

The 30-full-time employee reduction will be a small proportional amount in relation to the overall controlled group of full-time employees, which is dominated by Big Co.

ACA Reporting Requirements Upon the Acquisition

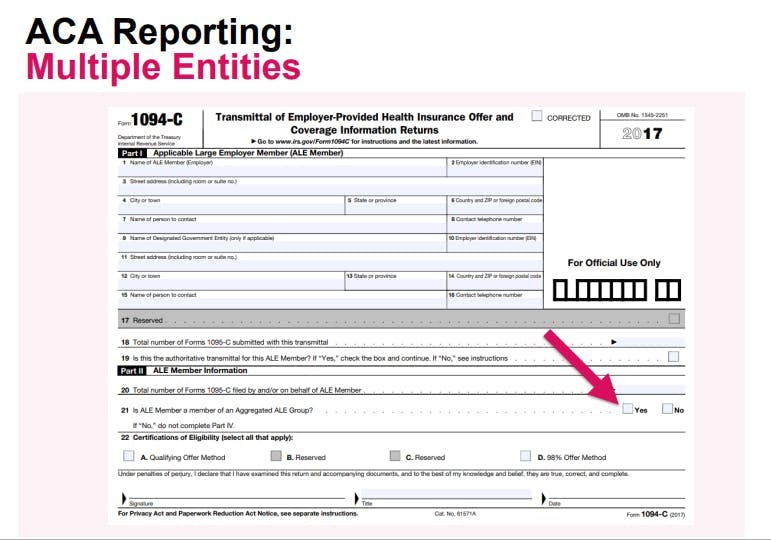

Form 1094-C:

Where an acquisition results in the ALE having multiple corporate entities in the controlled group (i.e., an Aggregated ALE Group), each subsidiary or related entity in the controlled group must file a separate Form 1094-C.

In other words, the small seller company becomes an Applicable Large Employer Member (ALEM) upon the acquisition that must file a separate Form 1094-C.

The Form 1094-C for each ALEM will contain the following:

Part II, Line 21: Each ALEM will answer “Yes” to question “Is ALE Member a member of an Aggregated ALE Group?”

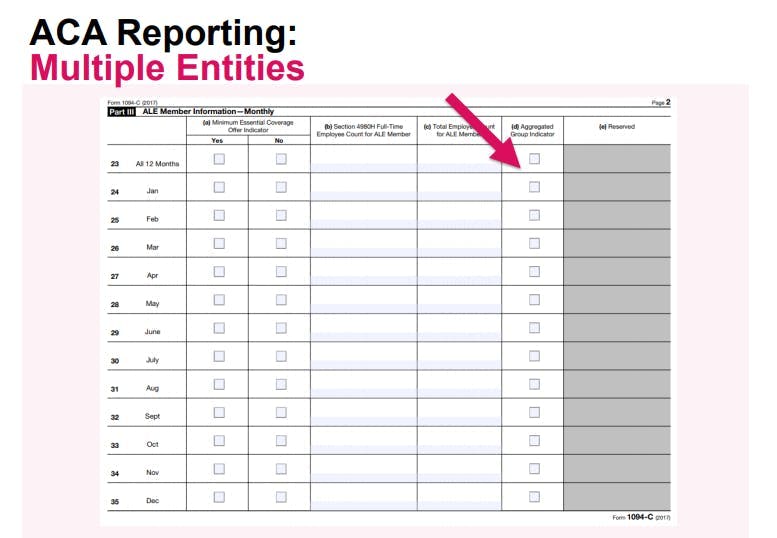

Part III, Column (d): For each month in which the controlled group existed, this “Aggregated Group Indicator” box will be checked.

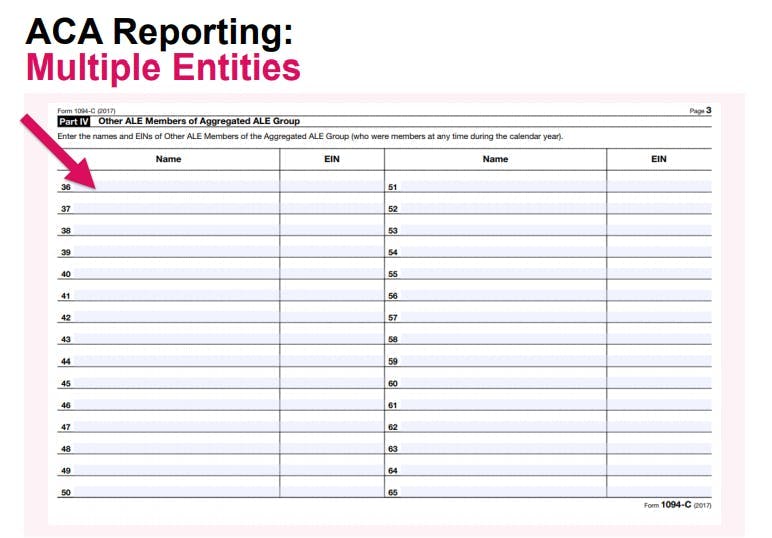

**Part IV: **This “Other ALE Members of Aggregated ALE Group” section will be completed listing the names of the other related entities in the controlled group (the other ALEMs) and their EINs.

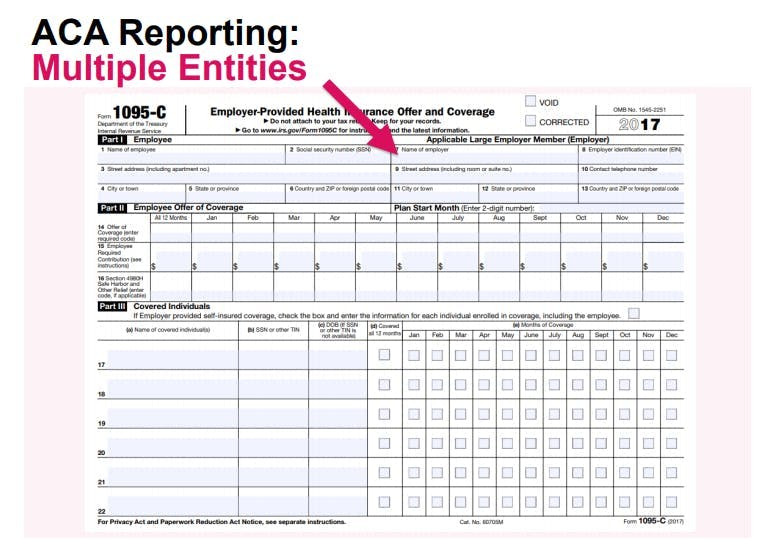

Form 1095-C:

The full-time employees of the seller ALEM must also receive a Form 1095-C with that ALEM’s corporate name and EIN. The buyer cannot simply use the parent EIN for all Forms 1095-C in an Aggregated ALE Group.

If an employee works for more than one ALEM in the Aggregated ALE Group in any calendar month, the ALEM for whom the employee worked the most hours of service in that calendar month is responsible for the employee’s Form 1095-C ACA reporting for that month.

The months of ACA reporting required for the small employer that becomes an ALEM upon the acquisition will only be those months that occurred after the acquisition.

Summary:

The buyer and the newly acquired small employer must complete separate Forms 1094-C for the year of the acquisition (and going forward).

The Forms 1094-C will report the Aggregated ALE Group (i.e., controlled group) status and list the other entity per the description above.

Full-time employees under the seller’s EIN will receive Forms 1095-C under the seller’s corporate name and EIN for the months after the acquisition (the months in which the seller was part of the buyer’s Aggregated ALE Group). Employees who terminated from the seller prior to the acquisition will not receive a Form 1095-C.

Regulations

Treas. Reg. §54.4980H-1(a):

(4) Applicable large employer. The term applicable large employer means, with respect to a calendar year, an employer that employed an average of at least 50 full-time employees (including full-time equivalent employees) on business days during the preceding calendar year. For rules relating to the determination of applicable large employer status, see §54.4980H-2.

…

(16) Employer. The term employer means the person that is the employer of an employee under the common-law standard. See § 31.3121(d)-1(c). For purposes of determining whether an employer is an applicable large employer, all persons treated as a single employer under section 414(b), (c), (m), or (o) are treated as a single employer. Thus, all employees of a controlled group of entities under section 414(b) or (c), an affiliated service group under section 414(m), or an entity in an arrangement described under section 414(o), are taken into account in determining whether the members of the controlled group or affiliated service group together are an applicable large employer. For purposes of determining applicable large employer status, the term employer also includes a predecessor employer (see paragraph (a)(36) of this section) and a successor employer.

Treas. Reg. §54.4980H-2(d), Example 1:

Example (1). (Applicable large employer/controlled group).

(i) Facts. For all of 2015 and 2016, Corporation Z owns 100 percent of all classes of stock of Corporation Y and Corporation X. Corporation Z has no employees at any time in 2015. For every calendar month in 2015, Corporation Y has 40 full-time employees and Corporation X has 60 full-time employees. Corporations Z, Y, and X are a controlled group of corporations under section 414(b).

(ii) Conclusion. Because Corporations Z, Y and X have a combined total of 100 full-time employees during 2015, Corporations Z, Y, and X together are an applicable large employer for 2016. Each of Corporations Z, Y and X is an applicable large employer member for 2016.

Treas. Reg. §54.4980H-4(a):

(a) In general. If an applicable large employer member fails to offer to its full-time employees (and their dependents) the opportunity to enroll in minimum essential coverage under an eligible employer-sponsored plan for any calendar month, and the applicable large employer member has received a Section 1411 Certification with respect to at least one full-time employee, an assessable payment is imposed…For purposes of this paragraph (a), an applicable large employer member is treated as offering such coverage to its full-time employees (and their dependents) for a calendar month if, for that month, it offers such coverage to all but five percent (or, if greater, five) of its full-time employees (provided that an employee is treated as having been offered coverage only if the employer also offers coverage to that employee’s dependents). For purposes of the preceding sentence, an employee in a limited non-assessment period for certain employees is not included in the calculation.

Treas. Reg. §54.4980H-4(e):

(e) Allocated reduction of 30 full-time employees. For purposes of the liability calculation under paragraph (a) of this section, with respect to each calendar month, an applicable large employer member’s number of full-time employees is reduced by that member’s allocable share of 30. The applicable large employer member’s allocation is equal to 30 allocated ratably among all members of the applicable large employer on the basis of the number of full-time employees employed by each applicable large employer member during the calendar month (after application of the rules of paragraph (d) of this section addressing employees who work for more than one applicable large employer member during a calendar month). If an applicable large employer member’s total allocation is not a whole number, the allocation is rounded to the next highest whole number. This rounding rule may result in the aggregate reduction for the entire group of applicable large employer members exceeding 30.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn